Top Cryptos to Invest in 2025: Trends and Investment Tips

As we approach 2025, the cryptocurrency market continues to evolve, offering exciting opportunities for investors. The landscape is shaped by emerging technologies, regulatory shifts, and the increasing integration of digital assets into traditional financial systems. In this article, we'll explore the key trends driving the market, highlight the top-performing cryptocurrencies to watch, and provide actionable investment tips for both retail and institutional investors. Key Trends Shaping the Crypto Market in 2025 1. Regulatory Clarity and Its Impact on Adoption In 2025, one of the most significant factors influencing the cryptocurrency market is the increasing regulatory clarity. Governments around the world are working to establish frameworks that will define how digital assets are taxed, traded, and used. The U.S. Securities and Exchange Commission (SEC) and other global regulatory bodies have been tightening their grip, but they also provide more security for institutional investors. For instance, the European Union's Markets in Crypto-Assets (MiCA) regulation, set to be implemented in 2025, will provide clear guidelines for crypto companies, helping to legitimize the sector and attract more investment. Key Insight: Regulatory developments are essential to the long-term success of cryptocurrencies, as clearer rules lead to greater investor confidence and mainstream adoption. 2. DeFi and TradFi Integration The integration of decentralized finance (DeFi) with traditional finance (TradFi) is another major trend in 2025. DeFi protocols, which allow users to borrow, lend, and trade assets without intermediaries, are gaining traction among institutional investors. At the same time, traditional financial institutions are increasingly partnering with DeFi platforms to leverage blockchain's speed, transparency, and cost efficiency. For example, JPMorgan Chase has already entered the DeFi space, partnering with blockchain companies to offer innovative services like tokenized assets. This trend is expected to continue into 2025, creating new opportunities for investors. Key Insight: The hybridization of DeFi and TradFi will open up new investment channels and drive crypto adoption further. 3. Stablecoins and Their Role in Market Stability Stablecoins, such as Tether (USDT) and USD Coin (USDC), have become crucial in the crypto ecosystem. In 2025, their role as a hedge against volatility will continue to grow, as more institutions and retail investors use them to facilitate transactions and store value. These digital currencies are pegged to real-world assets like the U.S. dollar, offering a safe haven in volatile market conditions. Stablecoins also facilitate cross-border payments and remittances, lowering transaction costs and improving financial inclusion. With growing demand for stability, stablecoins are becoming integral to both the crypto market and global financial systems. Key Insight: Stablecoins are becoming more than just a safe investment—they are vital tools in the global financial ecosystem, helping mitigate volatility and increasing the liquidity of crypto markets. 4. AI and Blockchain Synergy Artificial intelligence (AI) is increasingly being integrated with blockchain technology, particularly in the areas of data analysis, trading algorithms, and decentralized applications (dApps). By 2025, AI-driven tools are expected to enhance market predictions, making it easier for investors to analyze trends and execute trades more efficiently. AI is also used in decentralized finance protocols to optimize lending and borrowing, as well as in fraud detection. The convergence of AI and blockchain creates a more efficient and secure environment for crypto trading. Key Insight: AI will play a critical role in optimizing crypto markets and improving investment strategies, helping investors make more informed decisions. 5. Tokenization of Real-World Assets (RWA) Tokenizing real-world assets such as real estate, fine art, and commodities is a growing trend in the crypto space. By 2025, tokenization will allow investors to buy fractional ownership in these assets, increasing liquidity and providing new investment opportunities. For example, platforms like RealT and CurioInvest allow users to invest in tokenized real estate and luxury cars, respectively. This trend is expected to expand, enabling investors to diversify their portfolios with physical assets in a digital format. Key Insight: The tokenization of physical assets will revolutionize traditional investment opportunities, offering new ways to invest in a broader range of assets. Top Cryptocurrencies to Watch in 2025 1. Bitcoin (BTC) Bitcoin remains the gold standard of cryptocurrency, with a market cap surpassing $1 trillion. As we head into 2025, Bitcoin's position as a store of value and hedge against inflation remains strong. Institutional adoption continues to

As we approach 2025, the cryptocurrency market continues to evolve, offering exciting opportunities for investors. The landscape is shaped by emerging technologies, regulatory shifts, and the increasing integration of digital assets into traditional financial systems. In this article, we'll explore the key trends driving the market, highlight the top-performing cryptocurrencies to watch, and provide actionable investment tips for both retail and institutional investors.

Key Trends Shaping the Crypto Market in 2025

1. Regulatory Clarity and Its Impact on Adoption

In 2025, one of the most significant factors influencing the cryptocurrency market is the increasing regulatory clarity. Governments around the world are working to establish frameworks that will define how digital assets are taxed, traded, and used. The U.S. Securities and Exchange Commission (SEC) and other global regulatory bodies have been tightening their grip, but they also provide more security for institutional investors.

For instance, the European Union's Markets in Crypto-Assets (MiCA) regulation, set to be implemented in 2025, will provide clear guidelines for crypto companies, helping to legitimize the sector and attract more investment.

Key Insight: Regulatory developments are essential to the long-term success of cryptocurrencies, as clearer rules lead to greater investor confidence and mainstream adoption.

2. DeFi and TradFi Integration

The integration of decentralized finance (DeFi) with traditional finance (TradFi) is another major trend in 2025. DeFi protocols, which allow users to borrow, lend, and trade assets without intermediaries, are gaining traction among institutional investors. At the same time, traditional financial institutions are increasingly partnering with DeFi platforms to leverage blockchain's speed, transparency, and cost efficiency.

For example, JPMorgan Chase has already entered the DeFi space, partnering with blockchain companies to offer innovative services like tokenized assets. This trend is expected to continue into 2025, creating new opportunities for investors.

Key Insight: The hybridization of DeFi and TradFi will open up new investment channels and drive crypto adoption further.

3. Stablecoins and Their Role in Market Stability

Stablecoins, such as Tether (USDT) and USD Coin (USDC), have become crucial in the crypto ecosystem. In 2025, their role as a hedge against volatility will continue to grow, as more institutions and retail investors use them to facilitate transactions and store value. These digital currencies are pegged to real-world assets like the U.S. dollar, offering a safe haven in volatile market conditions.

Stablecoins also facilitate cross-border payments and remittances, lowering transaction costs and improving financial inclusion. With growing demand for stability, stablecoins are becoming integral to both the crypto market and global financial systems.

Key Insight: Stablecoins are becoming more than just a safe investment—they are vital tools in the global financial ecosystem, helping mitigate volatility and increasing the liquidity of crypto markets.

4. AI and Blockchain Synergy

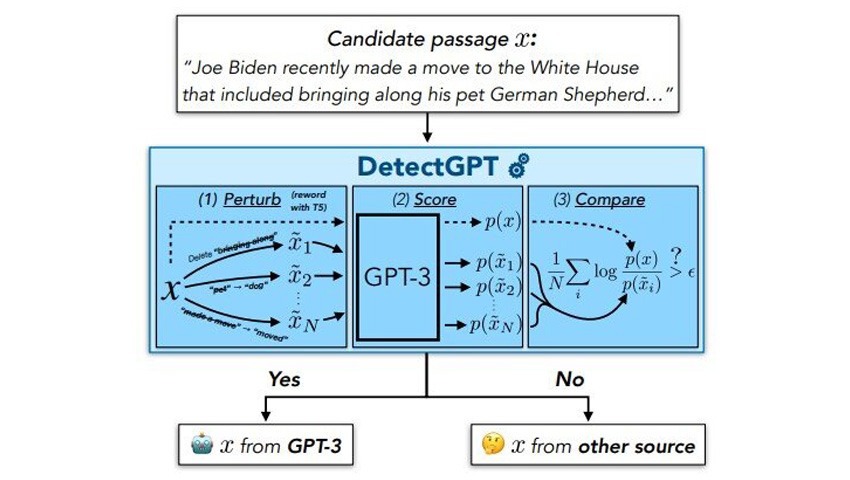

Artificial intelligence (AI) is increasingly being integrated with blockchain technology, particularly in the areas of data analysis, trading algorithms, and decentralized applications (dApps). By 2025, AI-driven tools are expected to enhance market predictions, making it easier for investors to analyze trends and execute trades more efficiently.

AI is also used in decentralized finance protocols to optimize lending and borrowing, as well as in fraud detection. The convergence of AI and blockchain creates a more efficient and secure environment for crypto trading.

Key Insight: AI will play a critical role in optimizing crypto markets and improving investment strategies, helping investors make more informed decisions.

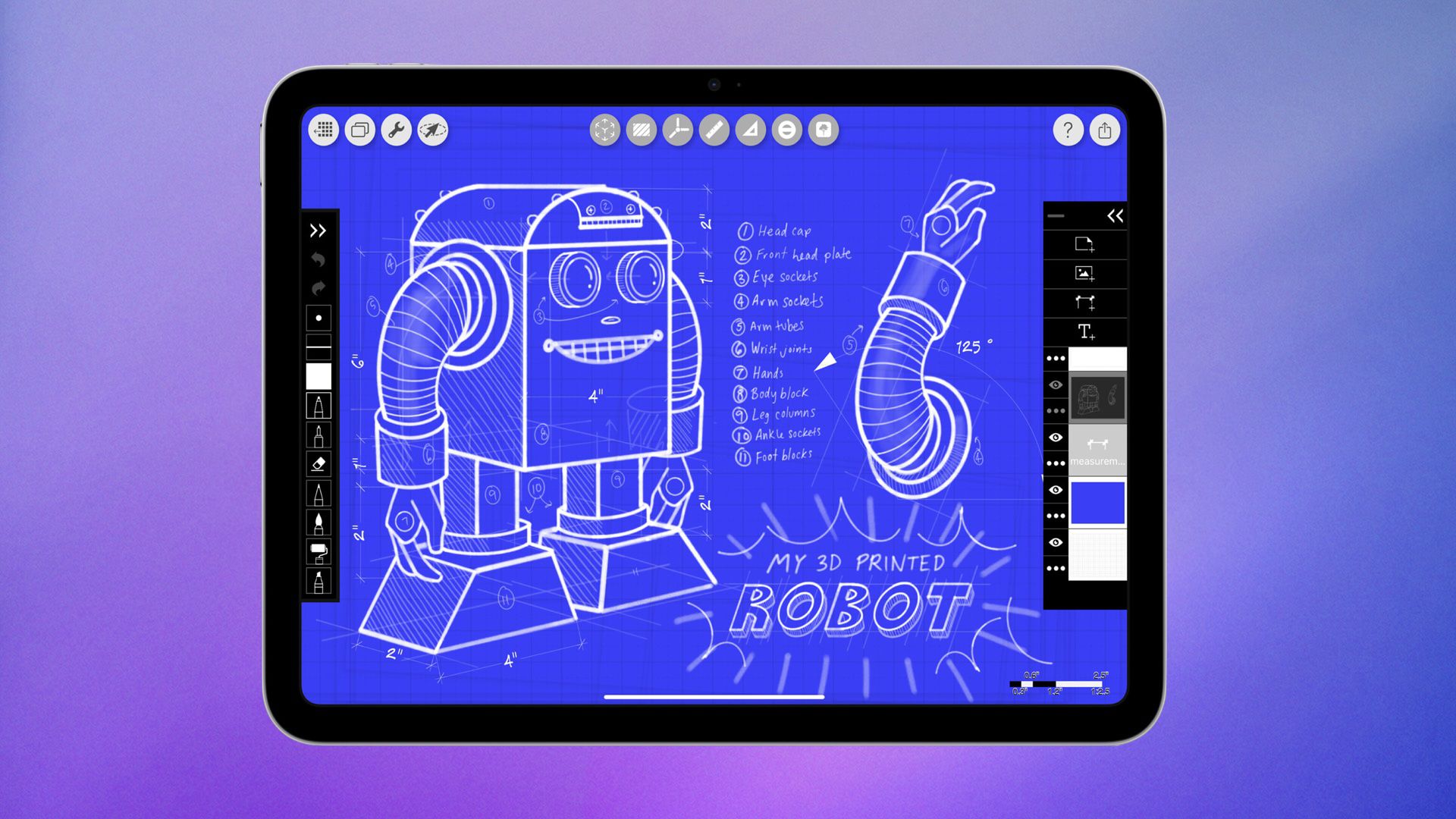

5. Tokenization of Real-World Assets (RWA)

Tokenizing real-world assets such as real estate, fine art, and commodities is a growing trend in the crypto space. By 2025, tokenization will allow investors to buy fractional ownership in these assets, increasing liquidity and providing new investment opportunities.

For example, platforms like RealT and CurioInvest allow users to invest in tokenized real estate and luxury cars, respectively. This trend is expected to expand, enabling investors to diversify their portfolios with physical assets in a digital format.

Key Insight: The tokenization of physical assets will revolutionize traditional investment opportunities, offering new ways to invest in a broader range of assets.

Top Cryptocurrencies to Watch in 2025

1. Bitcoin (BTC)

Bitcoin remains the gold standard of cryptocurrency, with a market cap surpassing $1 trillion. As we head into 2025, Bitcoin's position as a store of value and hedge against inflation remains strong. Institutional adoption continues to rise, with companies like Tesla and MicroStrategy holding large Bitcoin reserves.

Bitcoin's role in cross-border payments, coupled with its growing integration into traditional finance, makes it one of the most promising investments for 2025.

Key Insight: Bitcoin is expected to retain its dominance, and its adoption by institutions positions it as a long-term investment opportunity.

2. Ethereum (ETH)

Ethereum is the backbone of the decentralized finance (DeFi) ecosystem, and its upcoming network upgrades in 2025, including Ethereum 2.0, will enhance scalability, security, and sustainability. Ethereum's smart contract capabilities are pivotal to the growth of DeFi and NFTs, and its dominance in the decentralized application space is expected to continue.

Ethereum's transition to Proof of Stake (PoS) in Ethereum 2.0 will significantly reduce energy consumption, improving its environmental footprint and further driving adoption.

Key Insight: Ethereum's technological upgrades in 2025 will solidify its position as the leading platform for decentralized applications, making it a strong investment choice.

3. Solana (SOL)

Solana is known for its fast transaction speeds and low fees, which make it an attractive option for developers and investors alike. In 2025, Solana’s ecosystem is expected to continue expanding, especially with projects focused on DeFi and NFTs. The network's scalability and robust infrastructure put it in a strong position to compete with Ethereum and other blockchain platforms.

For up-to-date market data, check the SOL price to stay informed.

Key Insight: Solana's ability to scale efficiently and support high-speed transactions will drive its adoption in 2025, particularly in the DeFi space.

4. Polkadot (DOT)

Polkadot’s interoperability features allow different blockchains to communicate, making it a critical player in the multi-chain future of blockchain technology. By 2025, Polkadot’s ecosystem is expected to grow as more developers build decentralized applications (dApps) that can operate seamlessly across multiple blockchains.

Key Insight: Polkadot’s cross-chain interoperability offers significant advantages for decentralized applications and blockchain projects, making it a promising investment in 2025.

5. XRP (XRP)

Despite facing legal challenges in the U.S., XRP remains a major player in the cross-border payment space. With its partnerships with financial institutions and payment providers, XRP is positioned to capture a significant share of the global remittance market. In 2025, as regulatory clarity improves, XRP could see renewed growth.

Key Insight: XRP's utility in cross-border payments and its potential for adoption in traditional financial systems make it a cryptocurrency to watch in 2025.

Investment Tips for 2025

1. Diversify Your Portfolio

Diversification remains one of the best strategies for managing risk in the volatile crypto market. Instead of betting on a single cryptocurrency, consider allocating your funds across multiple assets, such as Bitcoin, Ethereum, and promising altcoins.

2. Evaluate the Technology and Use Case

When selecting cryptocurrencies for your portfolio, evaluate the underlying technology and its real-world application. Invest in projects that solve real-world problems, such as Polkadot’s interoperability and Solana’s high-speed transactions.

3. Stay Updated on Regulatory Developments

Crypto regulations are evolving rapidly, and staying informed about new laws is essential. Regulatory clarity will significantly affect the value and adoption of certain cryptocurrencies.

4. Long-Term vs. Short-Term Investment Strategies

Decide whether you want to focus on long-term holding for capital appreciation or short-term trading to capitalize on market volatility. Both strategies have their pros and cons, but long-term investments in established cryptocurrencies like Bitcoin and Ethereum have historically provided solid returns.

5. Risk Management and Security

Ensure that your crypto investments are secured in reputable wallets and exchanges. Use hardware wallets for large holdings and employ two-factor authentication (2FA) to protect your accounts. As with any investment, managing risk and securing assets are paramount.

Conclusion

The cryptocurrency market in 2025 is poised for growth, driven by regulatory clarity, technological advancements, and the increasing integration of digital assets into the global economy. By keeping an eye on emerging trends and investing in the top-performing cryptocurrencies like Bitcoin, Ethereum, and Solana, investors can position themselves for success in the coming year.

Whether you're a retail investor looking to diversify your portfolio or an institutional investor exploring new avenues for growth, the strategies outlined in this article provide a solid foundation for making informed investment decisions in 2025.

.jpg)

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[Research] Starting Web App in 2025: Vibe-coding, AI Agents….](https://media2.dev.to/dynamic/image/width%3D1000,height%3D500,fit%3Dcover,gravity%3Dauto,format%3Dauto/https:%2F%2Fdev-to-uploads.s3.amazonaws.com%2Fuploads%2Farticles%2Fby8z0auultdpyfrx5tx8.png)

![[DEALS] Koofr Cloud Storage: Lifetime Subscription (1TB) (80% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

-RTAガチ勢がSwitch2体験会でゼルダのラスボスを撃破して世界初のEDを流してしまう...【ゼルダの伝説ブレスオブザワイルドSwitch2-Edition】-00-06-05.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_roibu_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

.webp?#)

![M4 MacBook Air Drops to Just $849 - Act Fast! [Lowest Price Ever]](https://www.iclarified.com/images/news/97140/97140/97140-640.jpg)

![Apple Smart Glasses Not Close to Being Ready as Meta Targets 2025 [Gurman]](https://www.iclarified.com/images/news/97139/97139/97139-640.jpg)

![iPadOS 19 May Introduce Menu Bar, iOS 19 to Support External Displays [Rumor]](https://www.iclarified.com/images/news/97137/97137/97137-640.jpg)