Is AI Agents Really Driving the Crypto Boom or It’s Just a Fad?

The massive AI Agents boom is everywhere, from financial services to healthcare, education, and even entertainment. According to a report from Deloitte, 25% of enterprises using Gen AI are expected to deploy their own AI Agent by the end 2025. Speaking about crypto and web3, these new-age techs are no stranger to artificial intelligence (AI) agents. More than 113 AI agents coins are already listed on Coinmarketcap and Ethereum alone accounts to around $164 TVL. is the latest disruptor making waves in this dynamic space. Among the most intriguing advancements are AI agents—autonomous, adaptive programs capable of performing complex tasks. But are these AI agents truly driving the crypto boom, or are they just another passing trend? Let’s explore this fascinating topic in depth. What Are AI Agents in Crypto? A Glance AI agents are autonomous software programs designed to observe, analyze, and act on data. Unlike traditional algorithms that follow pre-set rules, AI agents learn and evolve through continuous interaction with their environment. This makes them particularly suited for dynamic and fast-paced industries like cryptocurrency. These agents excel in tasks requiring speed, precision, and adaptability. In the crypto world, AI agents are revolutionizing trading, security, decentralized finance (DeFi), and even NFT creation. Here’s what makes them stand out: Data Analysis: AI agents can analyze vast datasets in real time, uncovering insights that would take humans hours or days to identify. Decision-Making: They can execute trades or manage assets autonomously, often faster and more accurately than human counterparts. Learning: Through machine learning, they refine their processes based on past experiences, becoming smarter and more effective over time. Automation: By streamlining complex tasks like liquidity management, yield farming, and fraud detection, AI agents free up time for developers and investors. For instance, projects like Fetch.ai and SingularityNET deploy AI agents to manage decentralized systems, optimize energy grids, and automate financial processes, showcasing their versatility. Source Main Types of Crypto AI Agents AI agents come in various forms, each suited to specific use cases. Here are the primary types: Simple Reflex Agents Operate based on current observations and pre-defined rules. Example: A thermostat that activates heating at a set temperature. Model-Based Reflex Agents Use memory to build an internal model of the environment, enabling action in partially observable scenarios. Example: Robot vacuums mapping and cleaning rooms. Goal-Based Agents Plan actions to achieve specific objectives. Example: Navigation systems finding optimal routes. Utility-Based Agents Prioritize actions based on utility (e.g., speed, efficiency). Example: Route planners optimizing for fuel efficiency and time. Learning Agents Adapt and improve through feedback and past experiences. Example: Personalized e-commerce recommendations based on user preferences. These categories highlight the wide range of capabilities that AI agents can offer, from simple automation to advanced decision-making and self-improvement. How Businesses can Leverage Crypto AI Agents? AI agents are reshaping industries by automating processes, enhancing decision-making, and personalizing experiences. Their applications span across industries, but in crypto, their impact is particularly transformative. Here’s how they benefit modern businesses: 1. Smart, Automated Trading AI agents monitor and analyze crypto market trends in real time, identifying profitable opportunities faster than humans can. They: Execute trades instantly, capitalizing on fleeting opportunities. Adjust strategies dynamically to minimize risk and maximize returns. Detects emerging narratives and market trends using advanced algorithms, providing traders with actionable insights. 2. DeFi & Trading Portfolio Management In the complex world of DeFi, AI agents simplify operations by: Optimizing yield farming strategies to maximize returns. Monitoring smart contracts for vulnerabilities, enhancing security. Automating lending and borrowing processes, making DeFi more accessible to users of all experience levels. 3. Interactive NFTs and Digital Art AI agents enable the creation of intelligent NFTs (iNFTs) that evolve based on user interactions. These adaptive digital assets open new possibilities in gaming, art, and entertainment. Imagine owning an NFT that personalizes its appearance or functionality based on how you use it. 4. Enhanced Security Security is paramount in the crypto space, and AI agents employ technologies like Multi-Party Computation (MPC) to: Secure transactions and digital assets. Detect and prevent fraudulent activities. Monitor blockchain networks for unusual activities, reducing the risk of hacks and breaches. 5. Better Accessibi

The massive AI Agents boom is everywhere, from financial services to healthcare, education, and even entertainment. According to a report from Deloitte, 25% of enterprises using Gen AI are expected to deploy their own AI Agent by the end 2025.

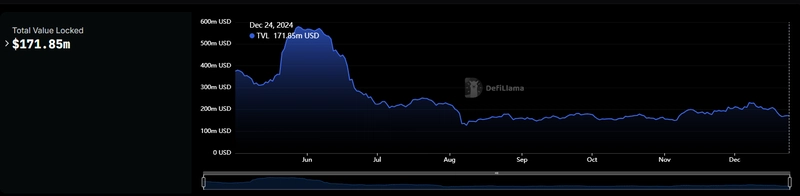

Speaking about crypto and web3, these new-age techs are no stranger to artificial intelligence (AI) agents. More than 113 AI agents coins are already listed on Coinmarketcap and Ethereum alone accounts to around $164 TVL. is the latest disruptor making waves in this dynamic space. Among the most intriguing advancements are AI agents—autonomous, adaptive programs capable of performing complex tasks. But are these AI agents truly driving the crypto boom, or are they just another passing trend? Let’s explore this fascinating topic in depth.

What Are AI Agents in Crypto? A Glance

AI agents are autonomous software programs designed to observe, analyze, and act on data. Unlike traditional algorithms that follow pre-set rules, AI agents learn and evolve through continuous interaction with their environment. This makes them particularly suited for dynamic and fast-paced industries like cryptocurrency.

These agents excel in tasks requiring speed, precision, and adaptability. In the crypto world, AI agents are revolutionizing trading, security, decentralized finance (DeFi), and even NFT creation. Here’s what makes them stand out:

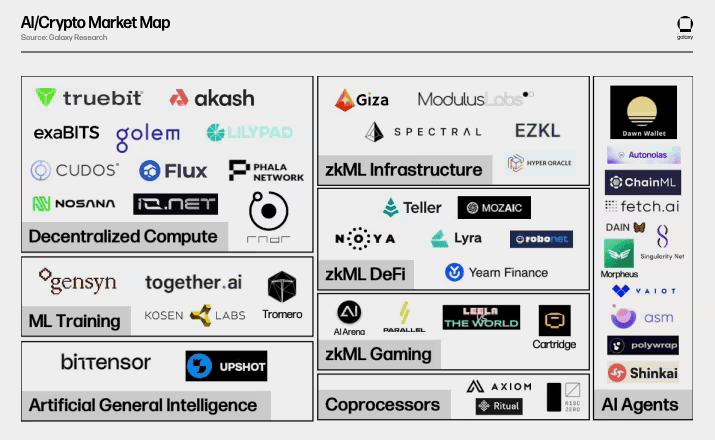

For instance, projects like Fetch.ai and SingularityNET deploy AI agents to manage decentralized systems, optimize energy grids, and automate financial processes, showcasing their versatility.

Main Types of Crypto AI Agents

AI agents come in various forms, each suited to specific use cases. Here are the primary types:

- Operate based on current observations and pre-defined rules.

- Example: A thermostat that activates heating at a set temperature.

- Use memory to build an internal model of the environment, enabling action in partially observable scenarios.

- Example: Robot vacuums mapping and cleaning rooms.

- Plan actions to achieve specific objectives.

- Example: Navigation systems finding optimal routes.

- Prioritize actions based on utility (e.g., speed, efficiency).

- Example: Route planners optimizing for fuel efficiency and time.

- Adapt and improve through feedback and past experiences.

- Example: Personalized e-commerce recommendations based on user preferences.

These categories highlight the wide range of capabilities that AI agents can offer, from simple automation to advanced decision-making and self-improvement.

How Businesses can Leverage Crypto AI Agents?

AI agents are reshaping industries by automating processes, enhancing decision-making, and personalizing experiences. Their applications span across industries, but in crypto, their impact is particularly transformative. Here’s how they benefit modern businesses:

1. Smart, Automated Trading

AI agents monitor and analyze crypto market trends in real time, identifying profitable opportunities faster than humans can. They:

2. DeFi & Trading Portfolio Management

In the complex world of DeFi, AI agents simplify operations by:

3. Interactive NFTs and Digital Art

AI agents enable the creation of intelligent NFTs (iNFTs) that evolve based on user interactions. These adaptive digital assets open new possibilities in gaming, art, and entertainment. Imagine owning an NFT that personalizes its appearance or functionality based on how you use it.

4. Enhanced Security

Security is paramount in the crypto space, and AI agents employ technologies like Multi-Party Computation (MPC) to:

5. Better Accessibility

AI agents manage wallets, approve transactions, and interact with smart contracts, making blockchain technology more user-friendly. This lowers barriers to entry for beginners and democratizes access to complex financial tools.

Crypto AI Agents- Key statistics

As per DefilLama, top three AI Agent projects; Morpheus AI, Gud.Tech, and AgentFi are some of the top projects that are contributing to AI Agents TVL’s top rankings. Morpheus AI (Ethereum) with $168.88M, Vander AI ($) TVL), AgentFi (Blast) with $151, 313, and Gud.Tech (Zircuit) with $12.33M.

Here’s how to Launch Your Own Crypto AI Agent?

Launching a crypto AI agent requires strategic planning and technical expertise. Here’s a roadmap to get you started:

1. Define Objectives

Identify the specific problem your AI agent will solve. For example, automating market analysis or optimizing liquidity pools.

2. Choose the Right Blockchain

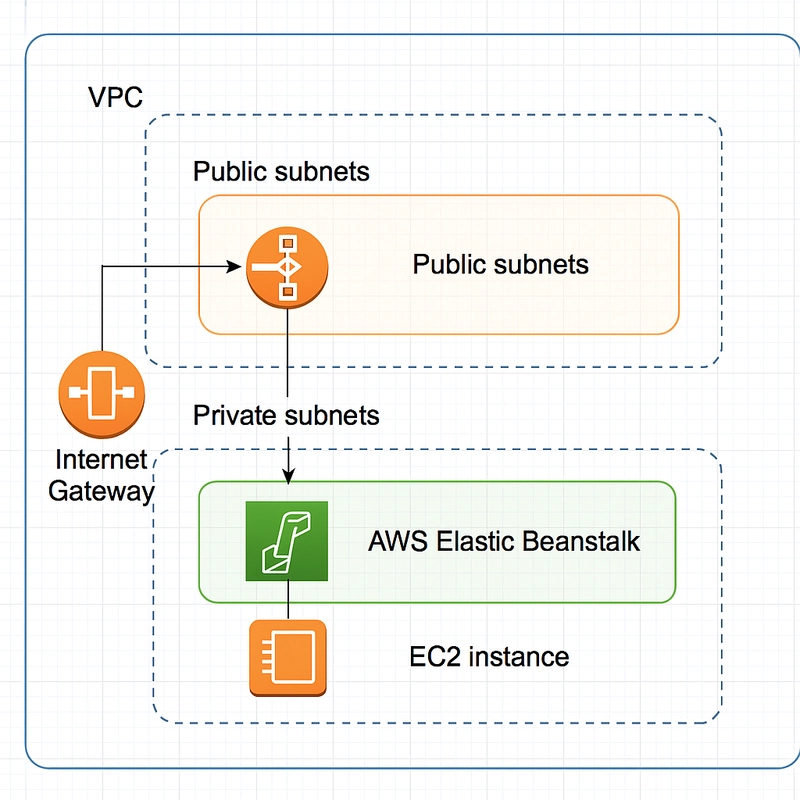

Choosing a right blockchain is the foundation and one of the critical steps of your AI agent project. Make sure you choose a massively scalable, modular, and high-performance chain to a scalable blockchain to support high-frequency interactions. Btw, LYNC offers a scalable, mobile-centric Layer2 that is best suited for futuristic AI agents.

3. Develop AI Algorithms

Train your AI models for tasks like prediction, decision-making, or fraud detection. Like, incorporating machine learning techniques for adaptability and continuous improvement.

4. Integrate Smart Contracts

Use smart contracts to automate transactions and enforce rules. Smart contracts ensure transparency and immutability, enhancing user trust.

5. Testing & Optimization

Ensure the AI agent performs well under different conditions. For this, conduct rigorous testing to identify and fix potential issues, ensuring reliability.

6. Launch

Create a compelling value proposition to attract users and investors. Engage communities through innovative tokenomics and governance models, fostering adoption and participation.

Possible Challenges

While the potential of AI agents is immense, there can be some challenges, such as:

1. Scalability

Ensuring blockchains can handle real-time interactions is a critical challenge. Existing platforms like Ethereum face congestion during high activity periods, which can lead to delays and increased transaction costs.

2. Transparency

Building trust in autonomous operations requires transparency. Users need clear insights into how AI agents make decisions and execute tasks.

3. Regulation

The evolving legal landscape presents challenges for deploying AI agents in crypto. Developers must navigate compliance requirements to avoid legal pitfalls.

4. Accuracy

Mitigating risks from AI errors or "hallucinations" is essential. Even minor inaccuracies in decision-making could lead to significant financial losses.

Web2 AI Agents vs Crypto AI Agents: A Comparison

The Future of AI Agents in Crypto

The rise of AI agents in crypto is no longer a matter of speculation—it’s a reality shaping the industry’s future. Here’s what lies ahead:

However, for AI agents to reach their full potential, challenges like scalability, transparency, and regulation must be addressed. Collaboration among developers, regulators, and the community will be essential to foster innovation while ensuring ethical and secure use of AI agents.

AI agents have come out as more than just a buzzword in the crypto space. They’re driving tangible innovations in trading, security, DeFi, and more. Their ability to analyze, adapt, and automate positions them as game-changers in an industry that thrives on cutting-edge technology.

Despite challenges, the potential benefits of AI agents far outweigh the risks. As these intelligent programs continue to evolve, they hold the promise of revolutionizing not just the crypto industry but the broader financial ecosystem. Whether a fleeting trend or a foundational technology, one thing is certain: the rise of AI agents is worth watching closely.

![[The AI Show Episode 142]: ChatGPT’s New Image Generator, Studio Ghibli Craze and Backlash, Gemini 2.5, OpenAI Academy, 4o Updates, Vibe Marketing & xAI Acquires X](https://www.marketingaiinstitute.com/hubfs/ep%20142%20cover.png)

![[DEALS] The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From drop-out to software architect with Jason Lengstorf [Podcast #167]](https://cdn.hashnode.com/res/hashnode/image/upload/v1743796461357/f3d19cd7-e6f5-4d7c-8bfc-eb974bc8da68.png?#)

.png?#)

_Christophe_Coat_Alamy.jpg?#)

(1).webp?#)

![Apple Considers Delaying Smart Home Hub Until 2026 [Gurman]](https://www.iclarified.com/images/news/96946/96946/96946-640.jpg)

![iPhone 17 Pro Won't Feature Two-Toned Back [Gurman]](https://www.iclarified.com/images/news/96944/96944/96944-640.jpg)

![Tariffs Threaten Apple's $999 iPhone Price Point in the U.S. [Gurman]](https://www.iclarified.com/images/news/96943/96943/96943-640.jpg)