How to identify fake payment apps and stay safe

India's digital payments landscape has undergone a revolution, but is also seeing a spurt in financial frauds. Fake payment apps that deceive merchants

Fake payment apps are counterfeits of legitimate payment applications. They closely resemble the UI, color schemes, and overall appearance of popular payment apps, often replicating the entire payment process and making them hard to distinguish at a glance.

Some of these fraudulent apps further enhance the illusion by imitating the sound of a payment notification, such as a beep or chime, to falsely suggest that a payment has been received. They can also produce convincing payment information to show a successful transaction, which is challenging to see though at a quick glance.

How to stay safe from fake payment apps

Fraudsters use fake payment apps to convince innocent victims that they have completed a transaction. In actuality, they use a fake app that only simulates the payment transaction flow; the victim realizes much later that the transaction was fabricated.

Here are a few tips that help you stay vigilant and safe from fake payment apps:

01. Check transaction history: Always verify transactions through your payment app or bank account. Do not rely solely on screenshots or notifications.

02. Inconsistent information: Look for discrepancies in the transaction details. Fake apps may have subtle errors or inconsistencies that can alert you to a scam.

03. Pressure tactics: Be wary of individuals who rush you to complete a transaction without allowing time for proper verification.

04. Unknown apps: Familiarize yourself with legitimate payment apps commonly used in your region. If anybody presents a payment through an unfamiliar app, proceed with caution.

What extra precautions should merchants take?

Merchants have increasingly become targets for fake payment apps. Fraudsters take advantage of the chaos in a busy shop or a merchant’s divided attention to deceive them with these fake payment apps. The merchant ends up offering goods and services at a loss due to the deception.

Here are some tips that will help merchants prevent frauds from fake payment apps.

01. Educate your staff: Ensure that all employees are aware of this scam and know how to spot fraudulent transactions.

02. Implement verification procedures: Develop a standard process for verifying payments before goods or services are provided. This might include waiting for the payment authentication from your PhonePe smart speaker (fake apps cannot trigger these alert messages), checking the transaction ID, or waiting for confirmation from your payment processor.

03. Report suspicious activity: If you encounter a suspected fake payment app, report it to the relevant authorities and your payment processor immediately.

How does PhonePe secure payments?

PhonePe has a robust security infrastructure, intelligent product interventions, active ecosystem partnerships, and a layered fraud reporting mechanism that combine to offer users a secure experience. Here are some of PhonePe’s Trust & Safety components:

01. Identity verification: PhonePe ensures that users are who they claim to be, and this is done through a combination of Know Your Customer (KYC) processes, biometric verification, and secure document authentication.

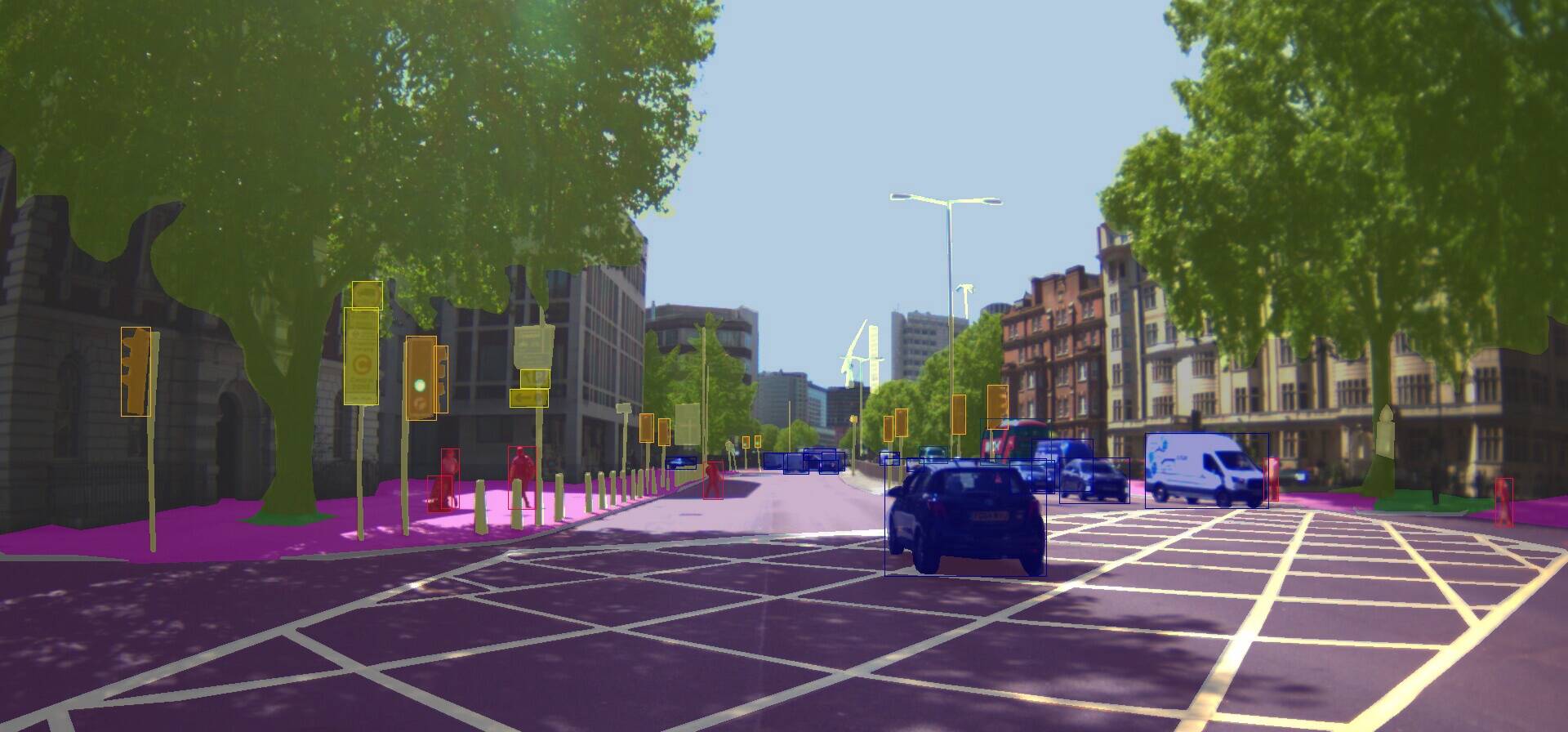

02. Real-time fraud detection: At PhonePe, the detection engine reports fraudulent transactions based on various signals such as customer demography, behavioral variables, and historical transaction patterns.

03. Proactive and reactive interventions: Even with strong identity verification and intelligent data-driven insights, intervention is crucial. Once a potential threat is identified, quick and precise action must be taken. More details here.

04. Enhanced account and transaction security: To keep the platform safe and secure, PhonePe validates the legitimacy of all accounts and transactions resulting from an account during various stages of the account’s lifecycle.

05. Partnership with law enforcement: PhonePe regularly engages and collaborates with cybercrime cells of various law enforcement agencies (LEAs) throughout the country. To ensure knowledge sharing, it conducts detailed sessions with various agencies, sharing the latest fraud patterns and engaging with LEAs to explore ways in which fraud can be reduced.

06. Consumer education: PhonePe’s continuously-updated trust and safety blog includes information about emerging fraudulent trends and scams, how users can spot them, and what resources are available for assistance.

PhonePe is actively combating fraudulent apps and channels impersonating its brand. The company has taken proactive action by approaching the Madras High Court, seeking a ‘John Doe’ injunction order to prevent infringements of its trademarks. Following the said lawsuit, the court ordered a social media platform to swiftly address and take down any fake payments apps posts, on receipt of any complaints from PhonePe.

In case you have been duped by a fraudster via PhonePe, you can immediately report such scams on the PhonePe app or by calling the customer care number (080–68727374 / 022–68727374), or on PhonePe’s official social media handles. You can also report fraud complaints at the nearest Cyber Crime Cell, register a complaint online at https://www.cybercrime.gov.in/, or contact the Cyber Crime Cell helpline on 1930.

Stay safe, stay vigilant, and keep your business secure.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![From fast food worker to cybersecurity engineer with Tae'lur Alexis [Podcast #169]](https://cdn.hashnode.com/res/hashnode/image/upload/v1745242807605/8a6cf71c-144f-4c91-9532-62d7c92c0f65.png?#)

![BPMN-procesmodellering [closed]](https://i.sstatic.net/l7l8q49F.png)

.webp?#)

![What’s new in Android’s April 2025 Google System Updates [U: 4/21]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/01/google-play-services-3.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Releases iOS 18.5 Beta 3 and iPadOS 18.5 Beta 3 [Download]](https://www.iclarified.com/images/news/97076/97076/97076-640.jpg)

![Apple Seeds visionOS 2.5 Beta 3 to Developers [Download]](https://www.iclarified.com/images/news/97077/97077/97077-640.jpg)

![Apple Seeds tvOS 18.5 Beta 3 to Developers [Download]](https://www.iclarified.com/images/news/97078/97078/97078-640.jpg)

![Apple Seeds watchOS 11.5 Beta 3 to Developers [Download]](https://www.iclarified.com/images/news/97079/97079/97079-640.jpg)