How AI is Reshaping Compliance Monitoring in 2025

Introduction: In 2025, the role of artificial intelligence (AI) in regulatory compliance has shifted from optional to essential. Organizations operating across geographies are subject to an evolving patchwork of regulations, including GDPR, HIPAA, PCI-DSS, and others. Traditional compliance methods are increasingly inadequate for keeping pace. AI is transforming compliance monitoring by enabling real-time insights, proactive risk detection, and automated audits. The Challenges of Traditional Compliance Monitoring: Manual compliance processes are often slow, error-prone, and reactive. Compliance teams struggle to manage disparate data sources, shifting regulations, and complex reporting requirements. This results in missed deadlines, audit fatigue, and higher costs. How AI Transforms Compliance: AI-powered systems can process vast amounts of structured and unstructured data, identify compliance risks, and trigger alerts. Natural language processing (NLP) tools can analyze contracts, emails, and regulatory updates. Machine learning models can predict compliance breaches based on past behavior. Predictive Compliance Analytics: AI provides predictive capabilities that forecast potential violations before they occur. This shift from reactive to proactive compliance is critical in industries like healthcare and finance, where violations can be costly and reputation-damaging. Real-World Examples: A healthcare provider uses AI to monitor access to electronic health records in real-time, flagging anomalies that indicate policy violations. A financial firm applies AI to detect suspicious transactions, aligning with anti-money laundering (AML) compliance. Conclusion: AI is revolutionizing the compliance landscape by automating routine tasks, enhancing accuracy, and enabling forward-looking risk management. Organizations partnering with Network Intelligence’s GRC services can future-proof their compliance strategies with intelligent automation.

Introduction: In 2025, the role of artificial intelligence (AI) in regulatory compliance has shifted from optional to essential. Organizations operating across geographies are subject to an evolving patchwork of regulations, including GDPR, HIPAA, PCI-DSS, and others. Traditional compliance methods are increasingly inadequate for keeping pace. AI is transforming compliance monitoring by enabling real-time insights, proactive risk detection, and automated audits.

The Challenges of Traditional Compliance Monitoring: Manual compliance processes are often slow, error-prone, and reactive. Compliance teams struggle to manage disparate data sources, shifting regulations, and complex reporting requirements. This results in missed deadlines, audit fatigue, and higher costs.

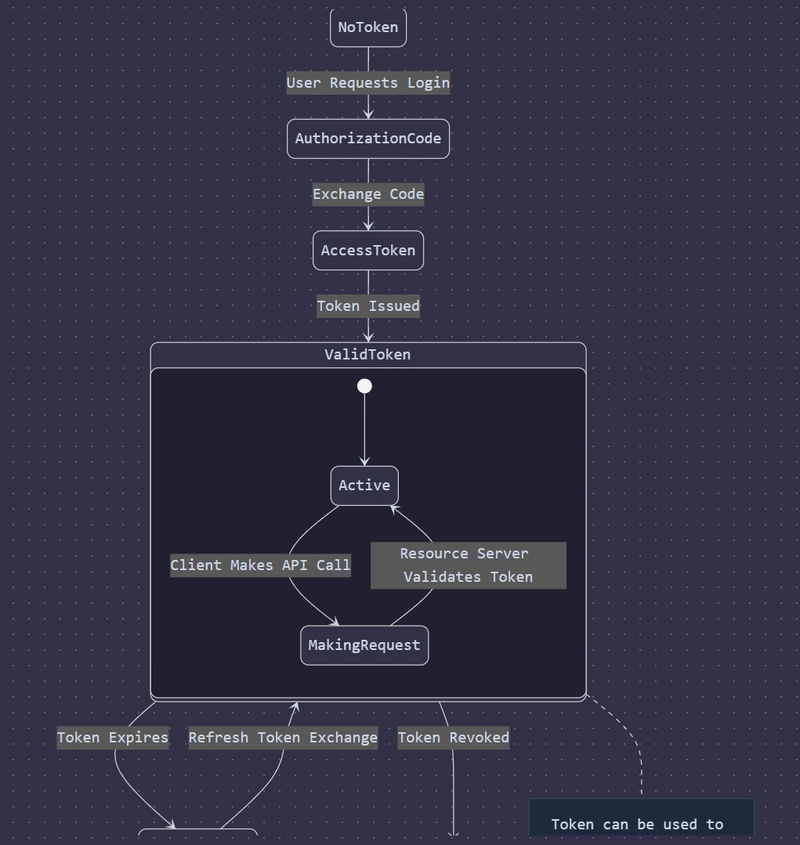

How AI Transforms Compliance: AI-powered systems can process vast amounts of structured and unstructured data, identify compliance risks, and trigger alerts. Natural language processing (NLP) tools can analyze contracts, emails, and regulatory updates. Machine learning models can predict compliance breaches based on past behavior.

Predictive Compliance Analytics: AI provides predictive capabilities that forecast potential violations before they occur. This shift from reactive to proactive compliance is critical in industries like healthcare and finance, where violations can be costly and reputation-damaging.

Real-World Examples: A healthcare provider uses AI to monitor access to electronic health records in real-time, flagging anomalies that indicate policy violations. A financial firm applies AI to detect suspicious transactions, aligning with anti-money laundering (AML) compliance.

Conclusion: AI is revolutionizing the compliance landscape by automating routine tasks, enhancing accuracy, and enabling forward-looking risk management. Organizations partnering with Network Intelligence’s GRC services can future-proof their compliance strategies with intelligent automation.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![[DEALS] The All-in-One Microsoft Office Pro 2019 for Windows: Lifetime License + Windows 11 Pro Bundle (89% off) & Other Deals Up To 98% Off](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Is this too much for a modular monolith system? [closed]](https://i.sstatic.net/pYL1nsfg.png)

_Andreas_Prott_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![What features do you get with Gemini Advanced? [April 2025]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2024/02/gemini-advanced-cover.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Shares Official Trailer for 'Long Way Home' Starring Ewan McGregor and Charley Boorman [Video]](https://www.iclarified.com/images/news/97069/97069/97069-640.jpg)

![Apple Watch Series 10 Back On Sale for $299! [Lowest Price Ever]](https://www.iclarified.com/images/news/96657/96657/96657-640.jpg)

![EU Postpones Apple App Store Fines Amid Tariff Negotiations [Report]](https://www.iclarified.com/images/news/97068/97068/97068-640.jpg)

![Apple Slips to Fifth in China's Smartphone Market with 9% Decline [Report]](https://www.iclarified.com/images/news/97065/97065/97065-640.jpg)