Decoding My Portfolio: How a Simple Tool Brought Clarity to My Stock Investments

Chapter 1: Diving into the World of Stocks Ethan had always been fascinated by the stock market. The idea of owning a piece of a company and potentially growing his wealth over time was incredibly appealing. After months of research and cautious observation, he finally decided to take the plunge. He started small, investing in a company he believed in, purchasing a few shares at what seemed like a reasonable price. The initial purchase was exciting, but soon, the market experienced some volatility. The price of the stock dipped, and Ethan, feeling a bit nervous but still confident in his long-term outlook, decided to buy more shares at the lower price. He figured it was a good opportunity to average down his cost basis. This became a pattern. Over the next few months, the stock price fluctuated, and Ethan made several more purchases at different price points. Chapter 2: The Growing Confusion of Multiple Purchases As Ethan continued to buy shares, he started to lose track of his average purchase price. He had bought shares at $50, then at $45, then at $52, and again at $48. He tried to calculate his average cost in his head, but with each new purchase, the calculation became more complex and confusing. He realized he needed a more systematic way to determine his average cost per share. He knew that understanding his average cost was crucial for making informed decisions about his investments. It would help him determine his breakeven point and assess the profitability of his holdings. Without this information, he felt like he was navigating the stock market without a clear compass. Chapter 3: Discovering the Simplicity of the Stock Average Calculator Frustrated with his manual calculations and the increasing complexity of his portfolio, Ethan decided to search online for a solution. He typed in phrases like "calculate average stock price" and "stock cost basis calculator." After exploring a few options, he stumbled upon a website offering a Stock Average Calculator. The name itself was exactly what he was looking for. He clicked on the link and was immediately greeted by a clean and intuitive interface. The Stock Average Calculator simply asked for two key pieces of information for each purchase: the number of shares bought and the price per share. There were fields to add multiple transactions, making it perfect for Ethan's situation. Effortlessly Calculating the Average Cost Ethan eagerly started inputting his purchase history. He entered the details of his first purchase: let's say 10 shares at $50. Then, he added his second purchase: 15 shares at $45. He continued this process for all his transactions, and with each entry, the Stock Average Calculator instantly displayed his updated average cost per share. Gaining a Clear Financial Picture The result was a clear and precise average cost that took into account all his purchases and the different prices he had paid. Ethan finally had the information he needed to understand his investment's performance accurately. He could now easily see his breakeven point and assess whether his current stock price was above or below his average cost. Making Informed Investment Decisions Armed with this knowledge, Ethan felt more confident in his investment decisions. When the stock price rose, he could see how much profit he had made based on his true average cost. When the price dipped, he could evaluate whether it was another opportunity to buy more shares and further lower his average cost, or if it was a sign to reconsider his investment thesis. The Stock Average Calculator had transformed his approach to stock investing. Chapter 4: A Tool for Strategic Investing Ethan continued to use the Stock Average Calculator as an integral part of his investment strategy. Whenever he made a new purchase of a stock he already owned, the first thing he would do is update the calculator to see how it affected his average cost. This helped him stay organized and maintain a clear understanding of his portfolio's composition. He also started using the calculator to plan his future investments. If he was considering buying more shares of a particular stock, he would use the Stock Average Calculator to estimate how different purchase amounts and prices would impact his average cost. This allowed him to make more strategic decisions about when and how much to invest. Chapter 5: From Confusion to Confidence in the Market Looking back, Ethan realized how much the Stock Average Calculator had simplified his stock investing journey. What was once a source of confusion and uncertainty had become clear and manageable. He no longer had to rely on guesswork or mental math to understand his average cost per share. The calculator provided him with the accurate and readily available information he needed to make informed decisions and navigate the stock market with greater confidence. His portfolio c

Chapter 1: Diving into the World of Stocks

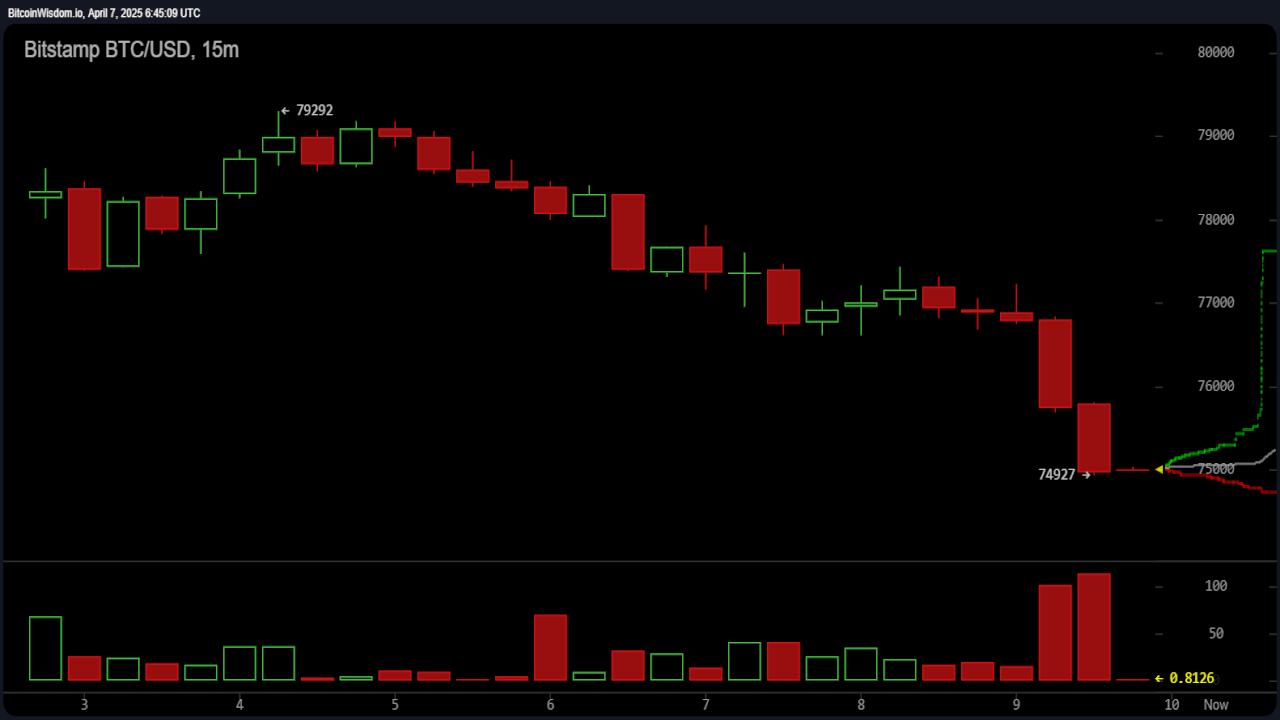

Ethan had always been fascinated by the stock market. The idea of owning a piece of a company and potentially growing his wealth over time was incredibly appealing. After months of research and cautious observation, he finally decided to take the plunge. He started small, investing in a company he believed in, purchasing a few shares at what seemed like a reasonable price.

The initial purchase was exciting, but soon, the market experienced some volatility. The price of the stock dipped, and Ethan, feeling a bit nervous but still confident in his long-term outlook, decided to buy more shares at the lower price. He figured it was a good opportunity to average down his cost basis. This became a pattern. Over the next few months, the stock price fluctuated, and Ethan made several more purchases at different price points.

Chapter 2: The Growing Confusion of Multiple Purchases

As Ethan continued to buy shares, he started to lose track of his average purchase price. He had bought shares at $50, then at $45, then at $52, and again at $48. He tried to calculate his average cost in his head, but with each new purchase, the calculation became more complex and confusing. He realized he needed a more systematic way to determine his average cost per share.

He knew that understanding his average cost was crucial for making informed decisions about his investments. It would help him determine his breakeven point and assess the profitability of his holdings. Without this information, he felt like he was navigating the stock market without a clear compass.

Chapter 3: Discovering the Simplicity of the Stock Average Calculator

Frustrated with his manual calculations and the increasing complexity of his portfolio, Ethan decided to search online for a solution. He typed in phrases like "calculate average stock price" and "stock cost basis calculator." After exploring a few options, he stumbled upon a website offering a Stock Average Calculator. The name itself was exactly what he was looking for.

He clicked on the link and was immediately greeted by a clean and intuitive interface. The Stock Average Calculator simply asked for two key pieces of information for each purchase: the number of shares bought and the price per share. There were fields to add multiple transactions, making it perfect for Ethan's situation.

Effortlessly Calculating the Average Cost

Ethan eagerly started inputting his purchase history. He entered the details of his first purchase: let's say 10 shares at $50. Then, he added his second purchase: 15 shares at $45. He continued this process for all his transactions, and with each entry, the Stock Average Calculator instantly displayed his updated average cost per share.

Gaining a Clear Financial Picture

The result was a clear and precise average cost that took into account all his purchases and the different prices he had paid. Ethan finally had the information he needed to understand his investment's performance accurately. He could now easily see his breakeven point and assess whether his current stock price was above or below his average cost.

Making Informed Investment Decisions

Armed with this knowledge, Ethan felt more confident in his investment decisions. When the stock price rose, he could see how much profit he had made based on his true average cost. When the price dipped, he could evaluate whether it was another opportunity to buy more shares and further lower his average cost, or if it was a sign to reconsider his investment thesis. The Stock Average Calculator had transformed his approach to stock investing.

Chapter 4: A Tool for Strategic Investing

Ethan continued to use the Stock Average Calculator as an integral part of his investment strategy. Whenever he made a new purchase of a stock he already owned, the first thing he would do is update the calculator to see how it affected his average cost. This helped him stay organized and maintain a clear understanding of his portfolio's composition.

He also started using the calculator to plan his future investments. If he was considering buying more shares of a particular stock, he would use the Stock Average Calculator to estimate how different purchase amounts and prices would impact his average cost. This allowed him to make more strategic decisions about when and how much to invest.

Chapter 5: From Confusion to Confidence in the Market

Looking back, Ethan realized how much the Stock Average Calculator had simplified his stock investing journey. What was once a source of confusion and uncertainty had become clear and manageable. He no longer had to rely on guesswork or mental math to understand his average cost per share. The calculator provided him with the accurate and readily available information he needed to make informed decisions and navigate the stock market with greater confidence.

His portfolio continued to grow, and while there were still ups and downs, Ethan felt much more in control of his investments thanks to this simple yet powerful tool.

Chapter 6: Simplify Your Stock Investing with a Stock Average Calculator

If you're investing in stocks and making multiple purchases of the same shares at different prices, a Stock Average Calculator is an essential tool for your arsenal. Just like Ethan, you can eliminate the confusion of manual calculations and gain a clear understanding of your average cost per share. This knowledge will empower you to make more informed investment decisions, track your portfolio's performance accurately, and navigate the stock market with greater confidence.

Stop guessing and start knowing. Use a Stock Average Calculator today and take control of your stock investments!

![[The AI Show Episode 142]: ChatGPT’s New Image Generator, Studio Ghibli Craze and Backlash, Gemini 2.5, OpenAI Academy, 4o Updates, Vibe Marketing & xAI Acquires X](https://www.marketingaiinstitute.com/hubfs/ep%20142%20cover.png)

![[DEALS] The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From drop-out to software architect with Jason Lengstorf [Podcast #167]](https://cdn.hashnode.com/res/hashnode/image/upload/v1743796461357/f3d19cd7-e6f5-4d7c-8bfc-eb974bc8da68.png?#)

.png?#)

_Christophe_Coat_Alamy.jpg?#)

.webp?#)

![Apple Considers Delaying Smart Home Hub Until 2026 [Gurman]](https://www.iclarified.com/images/news/96946/96946/96946-640.jpg)

![iPhone 17 Pro Won't Feature Two-Toned Back [Gurman]](https://www.iclarified.com/images/news/96944/96944/96944-640.jpg)

![Tariffs Threaten Apple's $999 iPhone Price Point in the U.S. [Gurman]](https://www.iclarified.com/images/news/96943/96943/96943-640.jpg)