Building Your First Trading Bot: A Step-by-Step Guide

Introduction In modern technology all the fields or industries have AI or Bot for easy to finish their work and clear doubts. The Bots are also introduced in trading. The trading bot is mainly used for easy trades, smart decisions, and analyzing ups and downs when you sleep. Also more precise trading techniques for more experience in trading. It creates trade as ease for beginners. In this guide you build your trading bot step by step in an easy way. What is a Trading Bot? A Trading Bot is a software program that automates trading activities based on a set of trading rules it buys or sells shares automatically based on the rules. It connects the trading platform via API(Application Programming interface). It is easy to create your own crypto trading bot for smooth experience. It collects the data, analyzes market trends, identifies patterns and reacts faster than humans. It consistently works for a process without any human intervention. Steps to Build Your Trading Bot To build your trading bot, follow some steps for a best and creative bot. Here are the steps: **Understand Of Trading bot **Before building your bot, gain the fundamentals of trading bot, how it interacts with markets, the types of strategies they implement. And choose which strategy matches your idea and implement it. It is important to understand the three core components of any trading bot market data collection, signal creation and execution. **Choose Your Platform and Tools **Select a reliable trading platform that offers an advanced API. Also consider its data management, commission fees, data feed quality, platform stability. For a creation bot highly recommended language is python for its readability. In this stage you want to choose the tools for your bot Panda NumPy TA-Lib **Define your Trading strategy **This is the main part of your bot. Create a clear and testable trading strategy. Your strategy includes every entry and exit of the shares at some level of point. Document your strategy precisely for a better trading experience. For a basic bot strategy must include technical strategy, price action and rule based; these are implemented with an exact match of your idea of business model. **Collect Market Data **For a successive trading bot, it needs previous and current trading records. Use the trading API or data provider to fetch price, volume and other relevant information. The API like Binance API, Yahoo Finance, Alpaca API. Also check the information is accurate and reliable, as it will directly impact your bot decisions. **Building Core Logic **The next step is to write code for your bot with your unique features. Translate your trading strategy into code. This involves writing functions to fetch data, analyze it, generate trading signals, and execute orders. Keep more attention to error handling and logging to track your bot performance and identify potential issues. **Test Your Bot **This stage is called backtesting. Before executing real money, test your bot with previous trading records and analyze your bot performance metrics like profit, win and drawdown. Simulate your bot's performance using historical data to evaluate its profitability and risk profile. Refine your bot strategy with previous backtest results. **Run the Bot **After the test is done, start with a demo account to test your bot in a live market environment without risking real money. Monitor its performance closely and make adjustments as needed. Once you are confident, you can deploy your bot to a live account with a small amount. **Optimize and Improve **Continuously monitor and analyze the performance of your bot. Always update your strategy with a trading algorithm. Stay updated with market conditions and adapt your bot. Also adding new features for user experience and improving your code and strategy according to it. Types Of Trading Bot There are different types of Trading bots based on their features and functions. Here are the types: **Arbitrage Bot **Arbitrage bots utilize price differences for the same asset across different exchanges. They simultaneously buy the asset on the exchange where it is cheaper and sell it on the exchange where it is more expensive, profiting from the price difference. **Trend Following bot **These bots analyze historical price data and technical indicators to identify trends. They enter long positions when an upward trend is detected and short positions when a downward trend is detected. **Market Making Bot **Market making bot aims to profit from the spread between the bid and ask prices. They place buy and sell orders on both sides of the order book, providing to the market. They profit from the small price differences between buy and sell orders. **Grid Trading Bot **Grid trading bot place a series of buy and sell orders at already fixed price intervals, creating a grid of orders. They aim to profit from price fluctuations within a defined range. When the price mo

Introduction

In modern technology all the fields or industries have AI or Bot for easy to finish their work and clear doubts. The Bots are also introduced in trading. The trading bot is mainly used for easy trades, smart decisions, and analyzing ups and downs when you sleep. Also more precise trading techniques for more experience in trading. It creates trade as ease for beginners. In this guide you build your trading bot step by step in an easy way.

What is a Trading Bot?

A Trading Bot is a software program that automates trading activities based on a set of trading rules it buys or sells shares automatically based on the rules. It connects the trading platform via API(Application Programming interface). It is easy to create your own crypto trading bot for smooth experience. It collects the data, analyzes market trends, identifies patterns and reacts faster than humans. It consistently works for a process without any human intervention.

Steps to Build Your Trading Bot

To build your trading bot, follow some steps for a best and creative bot. Here are the steps:

**Understand Of Trading bot

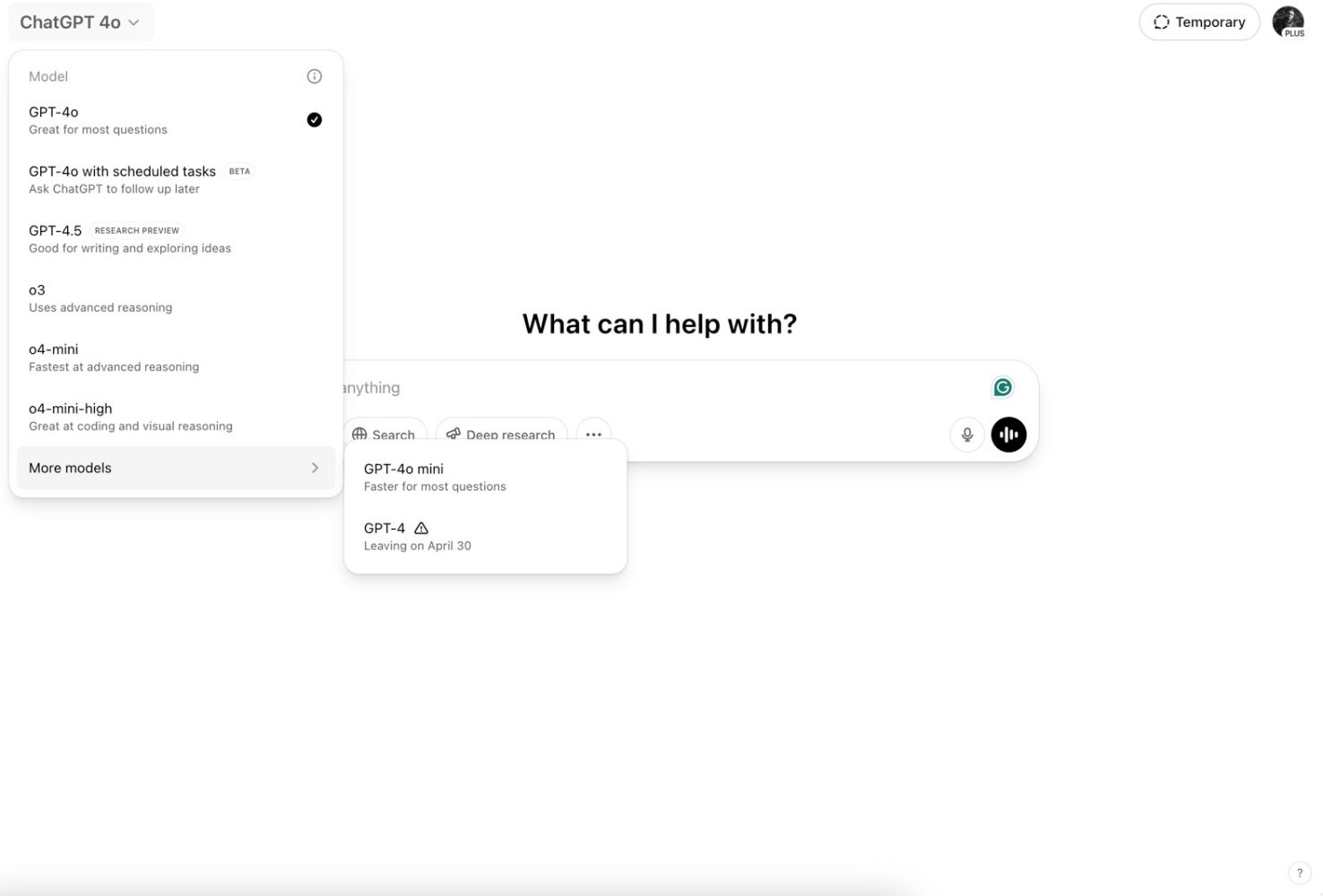

**Before building your bot, gain the fundamentals of trading bot, how it interacts with markets, the types of strategies they implement. And choose which strategy matches your idea and implement it. It is important to understand the three core components of any trading bot market data collection, signal creation and execution.

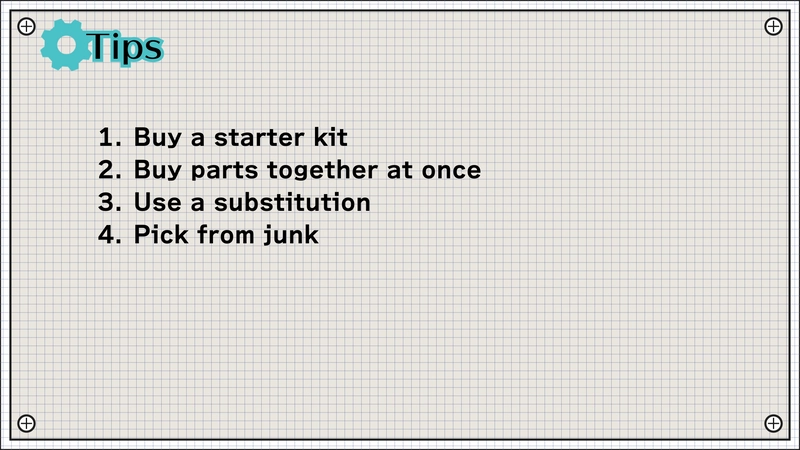

**Choose Your Platform and Tools

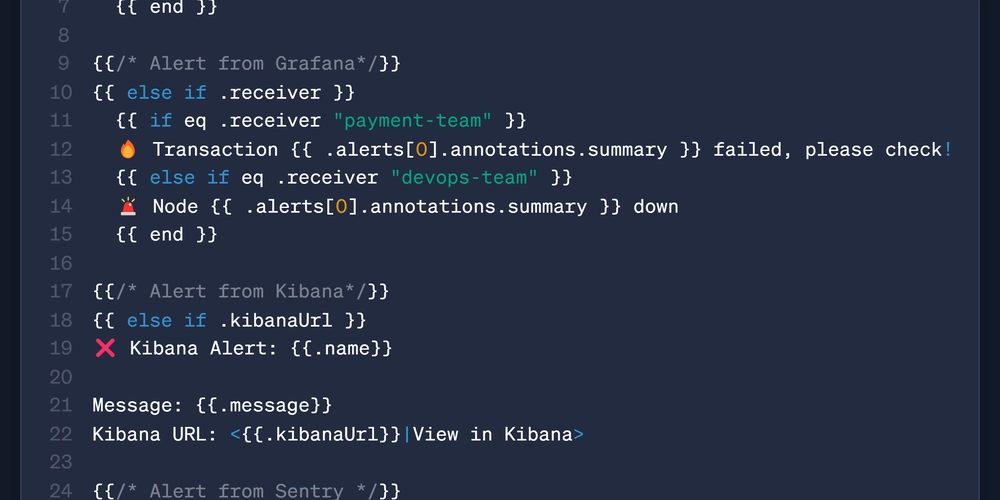

**Select a reliable trading platform that offers an advanced API. Also consider its data management, commission fees, data feed quality, platform stability. For a creation bot highly recommended language is python for its readability. In this stage you want to choose the tools for your bot

- Panda

- NumPy

- TA-Lib **Define your Trading strategy **This is the main part of your bot. Create a clear and testable trading strategy. Your strategy includes every entry and exit of the shares at some level of point. Document your strategy precisely for a better trading experience. For a basic bot strategy must include technical strategy, price action and rule based; these are implemented with an exact match of your idea of business model. **Collect Market Data **For a successive trading bot, it needs previous and current trading records. Use the trading API or data provider to fetch price, volume and other relevant information. The API like Binance API, Yahoo Finance, Alpaca API. Also check the information is accurate and reliable, as it will directly impact your bot decisions. **Building Core Logic **The next step is to write code for your bot with your unique features. Translate your trading strategy into code. This involves writing functions to fetch data, analyze it, generate trading signals, and execute orders. Keep more attention to error handling and logging to track your bot performance and identify potential issues. **Test Your Bot **This stage is called backtesting. Before executing real money, test your bot with previous trading records and analyze your bot performance metrics like profit, win and drawdown. Simulate your bot's performance using historical data to evaluate its profitability and risk profile. Refine your bot strategy with previous backtest results. **Run the Bot **After the test is done, start with a demo account to test your bot in a live market environment without risking real money. Monitor its performance closely and make adjustments as needed. Once you are confident, you can deploy your bot to a live account with a small amount. **Optimize and Improve **Continuously monitor and analyze the performance of your bot. Always update your strategy with a trading algorithm. Stay updated with market conditions and adapt your bot. Also adding new features for user experience and improving your code and strategy according to it.

Types Of Trading Bot

There are different types of Trading bots based on their features and functions. Here are the types:

**Arbitrage Bot

**Arbitrage bots utilize price differences for the same asset across different exchanges. They simultaneously buy the asset on the exchange where it is cheaper and sell it on the exchange where it is more expensive, profiting from the price difference.

**Trend Following bot

**These bots analyze historical price data and technical indicators to identify trends. They enter long positions when an upward trend is detected and short positions when a downward trend is detected.

**Market Making Bot

**Market making bot aims to profit from the spread between the bid and ask prices. They place buy and sell orders on both sides of the order book, providing to the market. They profit from the small price differences between buy and sell orders.

**Grid Trading Bot

**Grid trading bot place a series of buy and sell orders at already fixed price intervals, creating a grid of orders. They aim to profit from price fluctuations within a defined range. When the price moves up, sell orders are executed, and when it moves down, buy orders are executed.

Key Considerations

*Risk Management

* Implement robust risk management strategies to protect your capital. Use stop-loss orders, position sizing, and diversification to limit potential losses.

*Security

**Secure your API keys and trading account. Follow best practices for data protection and avoid storing sensitive information in plain text.

**Legal and Ethical Considerations

**Understand the legal and ethical implications of automated trading. Be aware of regulations and avoid practices that could manipulate the market.

**Reliability

* Ensure your bot is reliable and can handle unexpected market conditions. Test it thoroughly and implement fail-safes.

Key Features

- Real time data analysis: Capable of processing and analyzing live market data.

- Automated order execution: Ability to automatically place buy and sell orders.

- Customizable strategies: Allows users to define and implement their own trading strategies.

- Backtesting and optimization: Provides tools to test and improve trading strategies.

- Risk management features: Includes tools to manage and mitigate trading risks.

- Logging and reporting: Provides detailed logs and reports of trading activity.

Conclusion

Building your first trading bot is harder but you did it. It is a better experience from physically doing it. By following the steps you will build your first trading platform with specific features and trends. Remember to start small, test thoroughly, and continuously learn and adapt. Keep consider the factors that mentioned that result in your bot being an extraordinary trading bot and user experience bot. so stay informed and embrace the journey.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![GrandChase tier list of the best characters available [April 2025]](https://media.pocketgamer.com/artwork/na-33057-1637756796/grandchase-ios-android-3rd-anniversary.jpg?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.webp?#)

![Quick Share redesign looks more like a normal app with prep for ‘Receive’ and ‘Send’ tabs [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2024/12/quick-share-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![New Beats USB-C Charging Cables Now Available on Amazon [Video]](https://www.iclarified.com/images/news/97060/97060/97060-640.jpg)

![Apple M4 13-inch iPad Pro On Sale for $200 Off [Deal]](https://www.iclarified.com/images/news/97056/97056/97056-640.jpg)

![Apple Shares New 'Mac Does That' Ads for MacBook Pro [Video]](https://www.iclarified.com/images/news/97055/97055/97055-640.jpg)