AI in Mergers and Acquisitions: Analyzing Risks and Opportunities

Mergers and acquisitions (M&A) have long been pivotal strategies for companies seeking growth, diversification, and competitive advantage. However, these transactions are fraught with complexities and risks that can derail even the most promising deals. Traditional methods of analyzing these risks and opportunities can be time-consuming and prone to human error. Enter artificial intelligence (AI), a transformative technology that is revolutionizing how businesses approach M&A by enhancing data analysis, predictive modeling, and decision-making processes. AI leverages vast amounts of data to uncover patterns and insights that may not be immediately apparent to human analysts. It enables organizations to evaluate potential targets, assess synergies, and gauge market conditions with unprecedented accuracy. In this blog, we will delve deep into the role of AI in the M&A landscape, exploring how it helps identify risks and opportunities, streamline due diligence processes, and ultimately make more informed strategic decisions. We'll examine various applications of AI in M&A, including data analytics, risk assessment, valuation modeling, and post-merger integration. Additionally, we’ll discuss the potential challenges and ethical considerations that come with implementing AI in this field. By understanding the transformative power of AI in M&A, companies can better navigate the complexities of these transactions, ultimately leading to more successful outcomes. The Role of AI in Identifying Risks and Opportunities 1. Enhanced Data Analytics AI-driven tools can analyze vast datasets quickly and efficiently, providing insights into potential targets and market trends. By leveraging natural language processing (NLP) and machine learning algorithms, AI can sift through financial reports, press releases, social media, and other sources to identify relevant information about a company’s financial health, reputation, and competitive landscape. This comprehensive analysis helps executives make informed decisions about whether to pursue an acquisition or merger. **2. Predictive Analytics **Predictive analytics powered by AI can forecast future performance based on historical data. This capability allows companies to assess the potential success of a merger or acquisition by analyzing trends in the target company’s financial metrics, customer behavior, and market dynamics. For example, AI can evaluate how similar acquisitions in the past have performed, helping to predict whether the new venture is likely to succeed or face challenges. 3. Risk Assessment M&A transactions come with inherent risks, including regulatory hurdles, cultural misalignments, and operational challenges. AI can assess these risks by analyzing patterns in previous transactions and highlighting potential red flags. For instance, AI can evaluate cultural compatibility by analyzing employee sentiment through internal communications, social media activity, and employee reviews. This insight enables companies to address cultural integration issues proactively. 4. Streamlined Due Diligence Due diligence is a critical phase in the M&A process, involving extensive examination of a target company’s financial, legal, and operational aspects. AI can automate many aspects of this process, significantly reducing the time and resources required. Machine learning algorithms can quickly review contracts, financial statements, and compliance documents, identifying inconsistencies or areas of concern that warrant further investigation. This efficiency allows teams to focus on strategic decision-making rather than getting bogged down in paperwork. 5. Valuation Modeling Determining the fair value of a target company is crucial for successful M&A transactions. AI can enhance valuation models by incorporating a broader range of data points, including market conditions, competitor analysis, and economic indicators. Machine learning algorithms can identify trends and correlations that traditional models may overlook, resulting in more accurate and reliable valuations. This precision is particularly valuable in volatile markets, where external factors can significantly impact a company's worth. 6. Post-Merger Integration The success of an M&A transaction is often determined by how well the two companies integrate post-acquisition. AI can facilitate this process by analyzing employee performance, cultural fit, and operational efficiency to identify areas for improvement. AI-driven insights can help management teams develop targeted strategies for communication, training, and resource allocation, ensuring a smoother transition and minimizing disruptions. Challenges and Ethical Considerations While the benefits of AI in M&A are significant, there are also challenges and ethical considerations that must be addressed. One of the main concerns is data privacy. Companies must ensure they comply with data protection regulations when collecting and anal

Mergers and acquisitions (M&A) have long been pivotal strategies for companies seeking growth, diversification, and competitive advantage. However, these transactions are fraught with complexities and risks that can derail even the most promising deals. Traditional methods of analyzing these risks and opportunities can be time-consuming and prone to human error. Enter artificial intelligence (AI), a transformative technology that is revolutionizing how businesses approach M&A by enhancing data analysis, predictive modeling, and decision-making processes.

AI leverages vast amounts of data to uncover patterns and insights that may not be immediately apparent to human analysts. It enables organizations to evaluate potential targets, assess synergies, and gauge market conditions with unprecedented accuracy. In this blog, we will delve deep into the role of AI in the M&A landscape, exploring how it helps identify risks and opportunities, streamline due diligence processes, and ultimately make more informed strategic decisions.

We'll examine various applications of AI in M&A, including data analytics, risk assessment, valuation modeling, and post-merger integration. Additionally, we’ll discuss the potential challenges and ethical considerations that come with implementing AI in this field. By understanding the transformative power of AI in M&A, companies can better navigate the complexities of these transactions, ultimately leading to more successful outcomes.

The Role of AI in Identifying Risks and Opportunities

1. Enhanced Data Analytics

AI-driven tools can analyze vast datasets quickly and efficiently, providing insights into potential targets and market trends. By leveraging natural language processing (NLP) and machine learning algorithms, AI can sift through financial reports, press releases, social media, and other sources to identify relevant information about a company’s financial health, reputation, and competitive landscape. This comprehensive analysis helps executives make informed decisions about whether to pursue an acquisition or merger.

**2. Predictive Analytics

**Predictive analytics powered by AI can forecast future performance based on historical data. This capability allows companies to assess the potential success of a merger or acquisition by analyzing trends in the target company’s financial metrics, customer behavior, and market dynamics. For example, AI can evaluate how similar acquisitions in the past have performed, helping to predict whether the new venture is likely to succeed or face challenges.

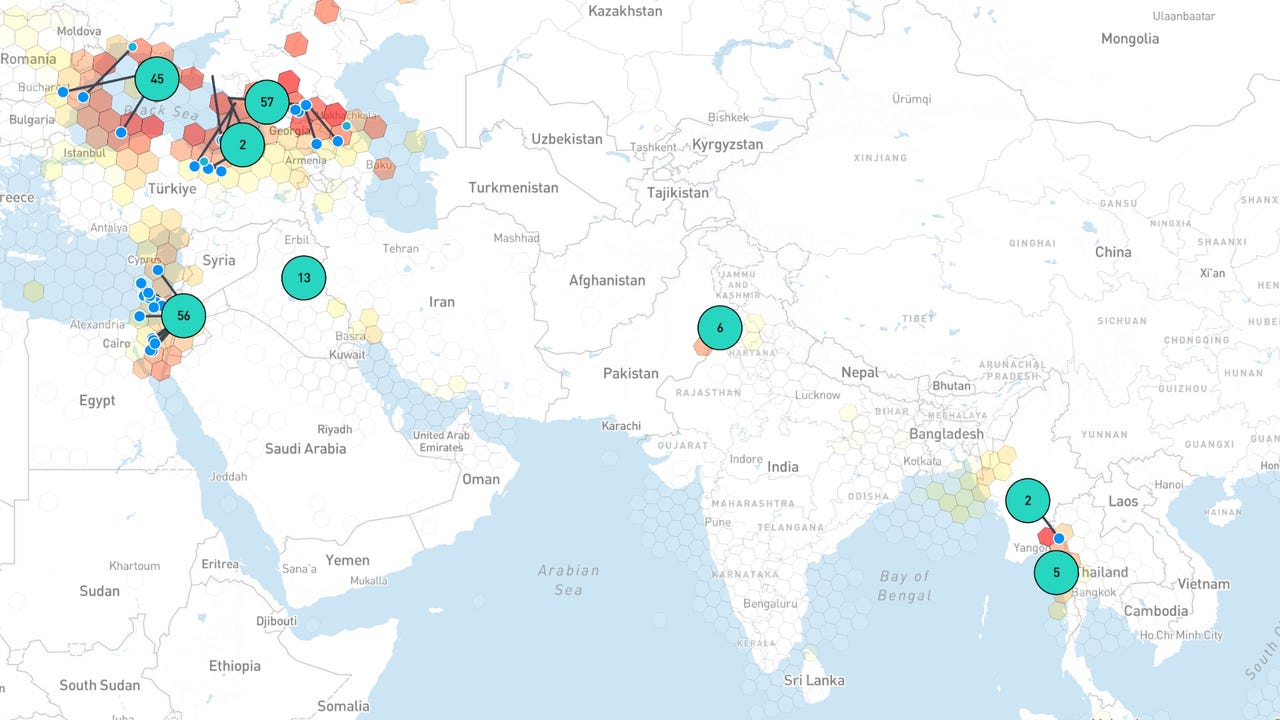

3. Risk Assessment

M&A transactions come with inherent risks, including regulatory hurdles, cultural misalignments, and operational challenges. AI can assess these risks by analyzing patterns in previous transactions and highlighting potential red flags. For instance, AI can evaluate cultural compatibility by analyzing employee sentiment through internal communications, social media activity, and employee reviews. This insight enables companies to address cultural integration issues proactively.

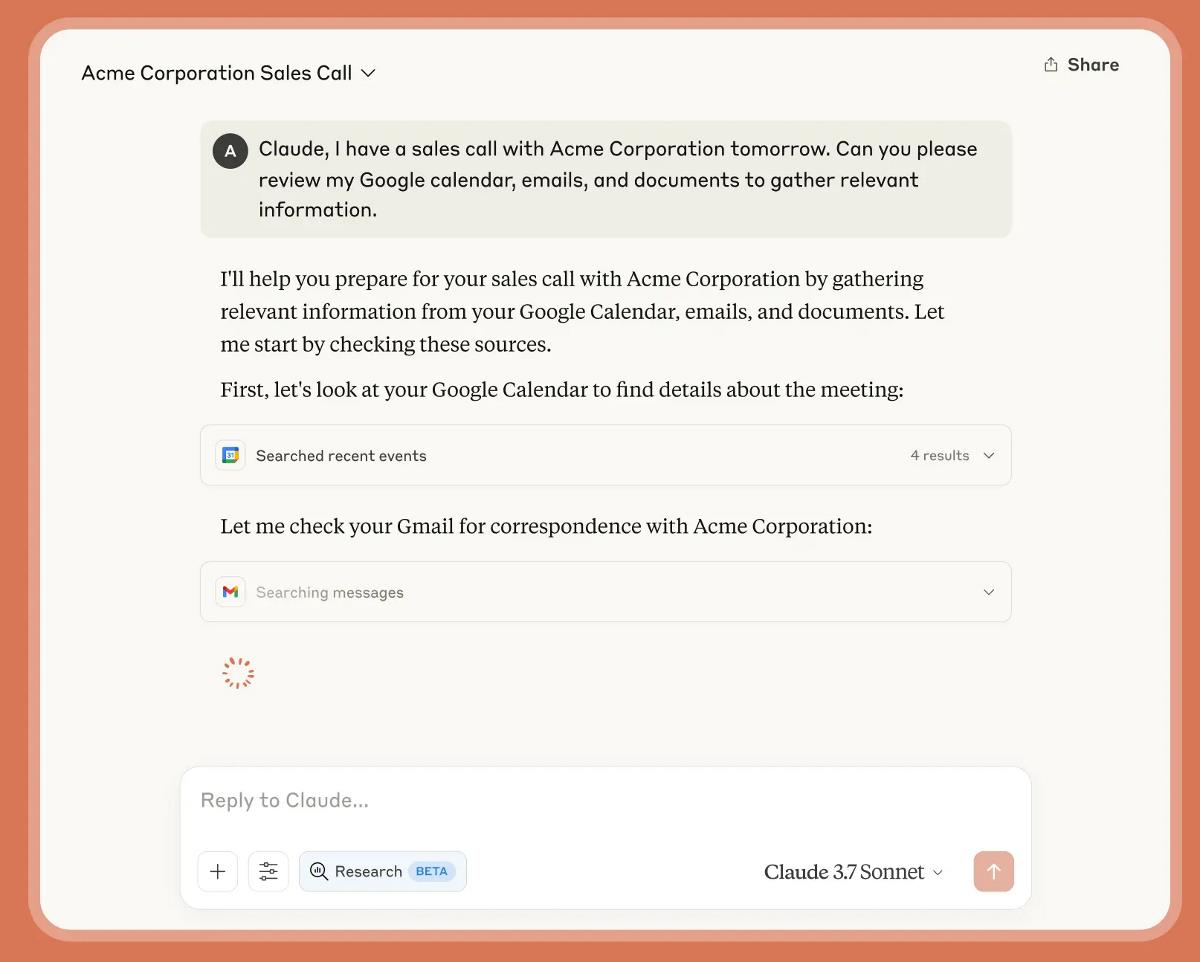

4. Streamlined Due Diligence

Due diligence is a critical phase in the M&A process, involving extensive examination of a target company’s financial, legal, and operational aspects. AI can automate many aspects of this process, significantly reducing the time and resources required. Machine learning algorithms can quickly review contracts, financial statements, and compliance documents, identifying inconsistencies or areas of concern that warrant further investigation. This efficiency allows teams to focus on strategic decision-making rather than getting bogged down in paperwork.

5. Valuation Modeling

Determining the fair value of a target company is crucial for successful M&A transactions. AI can enhance valuation models by incorporating a broader range of data points, including market conditions, competitor analysis, and economic indicators. Machine learning algorithms can identify trends and correlations that traditional models may overlook, resulting in more accurate and reliable valuations. This precision is particularly valuable in volatile markets, where external factors can significantly impact a company's worth.

6. Post-Merger Integration

The success of an M&A transaction is often determined by how well the two companies integrate post-acquisition. AI can facilitate this process by analyzing employee performance, cultural fit, and operational efficiency to identify areas for improvement. AI-driven insights can help management teams develop targeted strategies for communication, training, and resource allocation, ensuring a smoother transition and minimizing disruptions.

Challenges and Ethical Considerations

While the benefits of AI in M&A are significant, there are also challenges and ethical considerations that must be addressed. One of the main concerns is data privacy. Companies must ensure they comply with data protection regulations when collecting and analyzing personal information.

Additionally, reliance on AI algorithms can lead to biases if the underlying data is not representative or contains inaccuracies. It is essential to maintain a human touch in decision-making and validate AI-generated insights with expert judgment.

Another challenge is the integration of AI into existing workflows and systems. Companies must invest in training and resources to ensure their teams can effectively utilize AI tools. Change management is crucial to overcome resistance and foster a culture of innovation within the organization.

The Final Takeaway

AI is reshaping the landscape of mergers and acquisitions by providing powerful tools for analyzing risks and opportunities. By enhancing data analytics, predictive modeling, and due diligence processes, AI enables companies to make informed decisions that lead to successful transactions. However, it is essential to navigate the challenges and ethical considerations associated with AI implementation carefully. As technology continues to evolve, embracing AI will be vital for companies looking to thrive in the competitive world of M&A.

Frequently Asked Questions (FAQs)

1. How does AI improve the due diligence process in M&A?

AI streamlines the due diligence process by automating the review of financial, legal, and operational documents. Machine learning algorithms can quickly identify inconsistencies, flagging potential risks and areas that require further investigation, allowing teams to focus on strategic decision-making.

2. What types of data can AI analyze during M&A?

AI can analyze various types of data, including financial statements, market reports, news articles, social media activity, employee sentiment, and regulatory filings. This comprehensive analysis provides valuable insights into a target company's performance and risks.

3. Can AI predict the success of a merger or acquisition?

While AI cannot guarantee success, it can provide valuable predictive analytics based on historical data and trends. By analyzing past performance and identifying patterns, AI can help companies assess the likelihood of success for a proposed transaction.

4. What ethical considerations should companies be aware of when using AI in M&A?

Companies must ensure compliance with data privacy regulations when collecting and analyzing personal information. Additionally, it is essential to address potential biases in AI algorithms by validating insights with expert judgment and maintaining a human touch in decision-making.

5. How can companies ensure successful post-merger integration using AI?

AI can facilitate post-merger integration by analyzing employee performance, cultural fit, and operational efficiency. Insights generated by AI can help management teams develop targeted strategies for communication, training, and resource allocation, ensuring a smoother transition and minimizing disruptions.

6. What are the potential risks of relying on AI in M&A?

Relying solely on AI can lead to biases if the underlying data is not representative or contains inaccuracies. It is crucial to complement AI-generated insights with human expertise and judgment to make well-informed decisions.

7. How can companies address resistance to AI implementation in M&A?

Effective change management is essential for overcoming resistance to AI implementation. Companies should invest in training and resources to ensure teams are comfortable using AI tools, and they should foster a culture of innovation that encourages collaboration and adaptation to new technologies.

8. What role does AI play in risk assessment during M&A?

AI plays a crucial role in risk assessment by analyzing historical transaction data, identifying patterns, and flagging potential red flags. This allows companies to proactively address risks associated with cultural misalignments, regulatory hurdles, and operational challenges.

9. How can companies measure the success of AI integration in M&A?

Success can be measured through various metrics, including the speed and efficiency of the due diligence process, the accuracy of valuations, and the overall success of post-merger integration efforts. Companies should continuously monitor these metrics to assess the effectiveness of their AI strategies.

10. Is AI suitable for all types of M&A transactions?

While AI can provide valuable insights in many M&A transactions, its suitability may vary based on the size and complexity of the deal. Companies should assess their specific needs and resources before deciding to implement AI solutions in their M&A processes.

The integration of AI into mergers and acquisitions is not merely a trend but a paradigm shift that can redefine how businesses operate in a rapidly changing environment. As companies continue to navigate the complexities of the market, AI will play a pivotal role in ensuring they remain competitive and agile.

By harnessing the power of AI, organizations can identify lucrative opportunities, mitigate risks, and achieve successful integration in their M&A endeavors. Those who embrace this technology will likely lead the way in shaping the future of M&A, driving innovation, and unlocking new potential for growth.

As we move forward, it’s clear that AI will not just enhance the M&A process; it will redefine it, making it more efficient, data-driven, and ultimately, more successful. This technology is set to be a game changer in the world of finance, where informed decisions are paramount to achieving strategic goals.

Companies must be proactive in adopting AI and continuously adapting their strategies to leverage its full potential.

If you have further inquiries or want to explore more about how AI can impact M&A transactions, feel free to reach out. The journey to successfully integrating AI into your M&A strategy could be the key to unlocking unparalleled growth and success in your business.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![GrandChase tier list of the best characters available [April 2025]](https://media.pocketgamer.com/artwork/na-33057-1637756796/grandchase-ios-android-3rd-anniversary.jpg?#)

![Apple M4 13-inch iPad Pro On Sale for $200 Off [Deal]](https://www.iclarified.com/images/news/97056/97056/97056-640.jpg)

![Apple Shares New 'Mac Does That' Ads for MacBook Pro [Video]](https://www.iclarified.com/images/news/97055/97055/97055-640.jpg)