Accounting and Financial Application Development

In today's fast-paced business environment, accounting and financial applications play a crucial role in managing finances, ensuring compliance, and providing insights for decision-making. Whether you’re developing a personal finance tracker or a comprehensive accounting system for enterprises, understanding the essentials of financial application development is vital. This post outlines key features, technologies, and best practices for building successful financial software. Core Features of Financial Applications User Authentication and Authorization: Secure user access and role-based permissions. General Ledger Management: Track and manage all financial transactions. Invoicing and Billing: Generate and send invoices, manage recurring payments. Expense Tracking: Record and categorize business expenses. Financial Reporting: Generate balance sheets, income statements, and cash flow reports. Budgeting and Forecasting: Tools for setting budgets and predicting future financial performance. Integration with Banking Systems: Automate transactions and synchronize with bank statements. Technology Stack Suggestions Frontend: React.js, Angular, or Vue.js for creating responsive user interfaces. Backend: Node.js, Django, or Ruby on Rails for handling business logic. Database: PostgreSQL or MySQL for relational data storage; MongoDB for NoSQL solutions. Payment Gateways: Stripe, PayPal, or Square for processing payments. Cloud Platforms: AWS, Google Cloud, or Azure for hosting and data storage. Sample User Registration API (Node.js Example) const express = require('express'); const bodyParser = require('body-parser'); const bcrypt = require('bcrypt'); const app = express(); app.use(bodyParser.json()); let users = []; // Mock database for users // User registration endpoint app.post('/register', async (req, res) => { const { username, password } = req.body; const hashedPassword = await bcrypt.hash(password, 10); users.push({ username, password: hashedPassword }); res.status(201).send({ message: 'User registered successfully!' }); }); app.listen(3000, () => { console.log('Server is running on port 3000'); }); Ensuring Compliance and Security Data Protection: Implement encryption for sensitive data both in transit and at rest. Regulatory Compliance: Stay updated with regulations like GDPR, PCI-DSS, and local tax laws. Audit Trails: Maintain logs of transactions and changes for accountability. Access Controls: Enforce strong access controls and user permissions. Best Practices for Financial Application Development Start with clear requirements gathering and user stories to guide development. Design a user-friendly interface with intuitive navigation for users of all backgrounds. Incorporate responsive design to ensure usability across devices (desktops, tablets, mobile). Implement thorough testing strategies, including unit testing, integration testing, and user acceptance testing. Continuously gather user feedback for iterative improvements and feature enhancements. Conclusion Developing accounting and financial applications requires a blend of technical skills, an understanding of financial principles, and a focus on user experience. By prioritizing security, compliance, and usability, you can build robust applications that empower users to manage their finances effectively. Start with a clear vision, adopt best practices, and stay informed about industry trends to create successful financial software.

In today's fast-paced business environment, accounting and financial applications play a crucial role in managing finances, ensuring compliance, and providing insights for decision-making. Whether you’re developing a personal finance tracker or a comprehensive accounting system for enterprises, understanding the essentials of financial application development is vital. This post outlines key features, technologies, and best practices for building successful financial software.

Core Features of Financial Applications

- User Authentication and Authorization: Secure user access and role-based permissions.

- General Ledger Management: Track and manage all financial transactions.

- Invoicing and Billing: Generate and send invoices, manage recurring payments.

- Expense Tracking: Record and categorize business expenses.

- Financial Reporting: Generate balance sheets, income statements, and cash flow reports.

- Budgeting and Forecasting: Tools for setting budgets and predicting future financial performance.

- Integration with Banking Systems: Automate transactions and synchronize with bank statements.

Technology Stack Suggestions

- Frontend: React.js, Angular, or Vue.js for creating responsive user interfaces.

- Backend: Node.js, Django, or Ruby on Rails for handling business logic.

- Database: PostgreSQL or MySQL for relational data storage; MongoDB for NoSQL solutions.

- Payment Gateways: Stripe, PayPal, or Square for processing payments.

- Cloud Platforms: AWS, Google Cloud, or Azure for hosting and data storage.

Sample User Registration API (Node.js Example)

const express = require('express');

const bodyParser = require('body-parser');

const bcrypt = require('bcrypt');

const app = express();

app.use(bodyParser.json());

let users = []; // Mock database for users

// User registration endpoint

app.post('/register', async (req, res) => {

const { username, password } = req.body;

const hashedPassword = await bcrypt.hash(password, 10);

users.push({ username, password: hashedPassword });

res.status(201).send({ message: 'User registered successfully!' });

});

app.listen(3000, () => {

console.log('Server is running on port 3000');

});

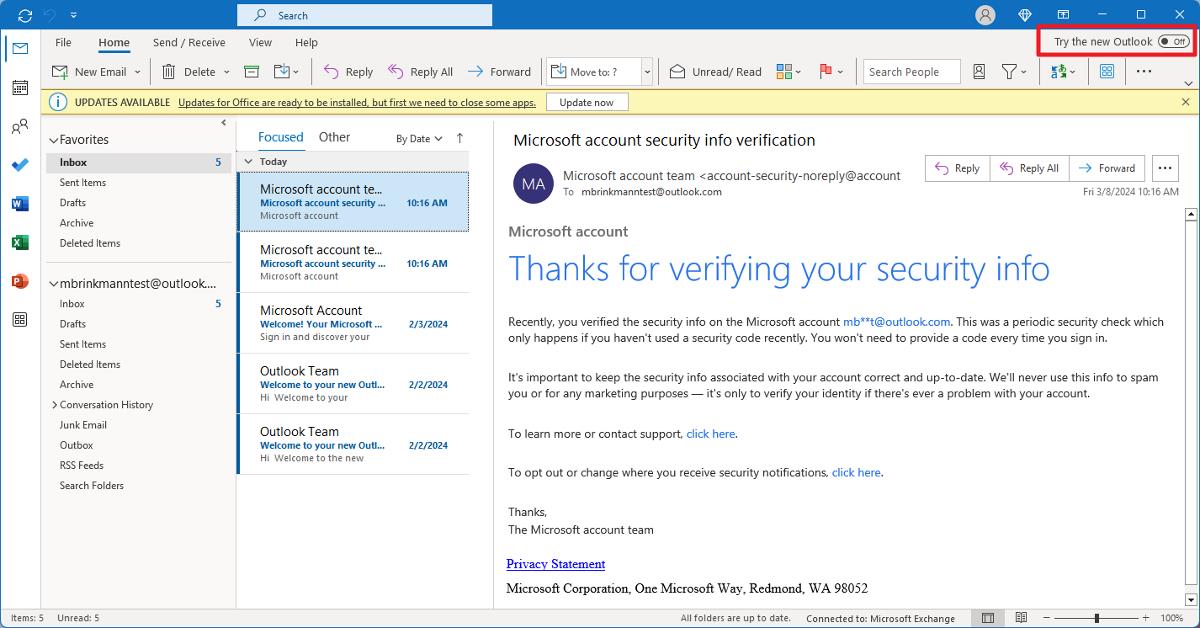

Ensuring Compliance and Security

- Data Protection: Implement encryption for sensitive data both in transit and at rest.

- Regulatory Compliance: Stay updated with regulations like GDPR, PCI-DSS, and local tax laws.

- Audit Trails: Maintain logs of transactions and changes for accountability.

- Access Controls: Enforce strong access controls and user permissions.

Best Practices for Financial Application Development

- Start with clear requirements gathering and user stories to guide development.

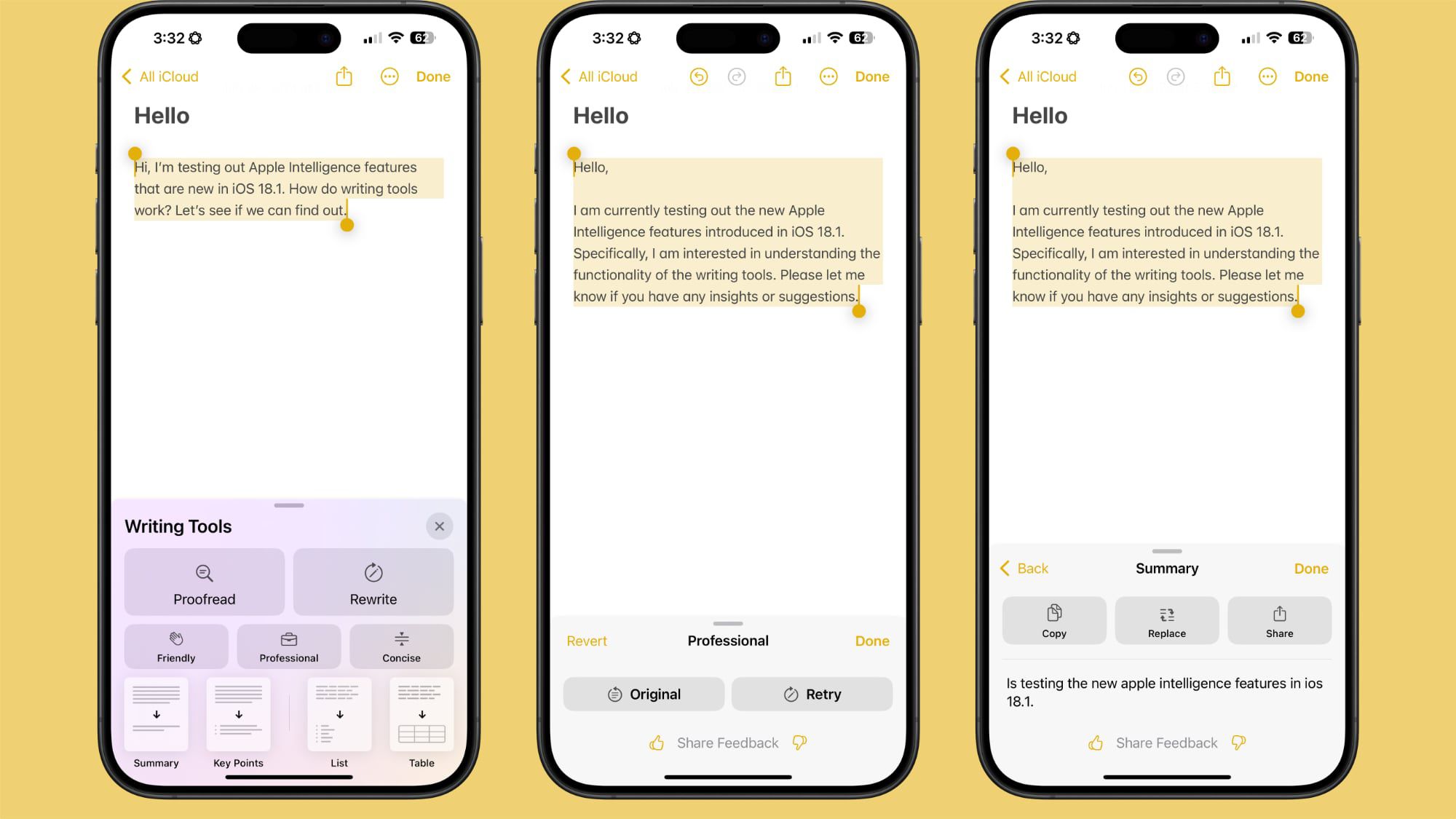

- Design a user-friendly interface with intuitive navigation for users of all backgrounds.

- Incorporate responsive design to ensure usability across devices (desktops, tablets, mobile).

- Implement thorough testing strategies, including unit testing, integration testing, and user acceptance testing.

- Continuously gather user feedback for iterative improvements and feature enhancements.

Conclusion

Developing accounting and financial applications requires a blend of technical skills, an understanding of financial principles, and a focus on user experience. By prioritizing security, compliance, and usability, you can build robust applications that empower users to manage their finances effectively. Start with a clear vision, adopt best practices, and stay informed about industry trends to create successful financial software.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Rogue Company Elite tier list of best characters [April 2025]](https://media.pocketgamer.com/artwork/na-33136-1657102075/rogue-company-ios-android-tier-cover.jpg?#)

.webp?#)

![Here’s the first live demo of Android XR on Google’s prototype smart glasses [Video]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/04/google-android-xr-ted-glasses-demo-3.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![New Beats USB-C Charging Cables Now Available on Amazon [Video]](https://www.iclarified.com/images/news/97060/97060/97060-640.jpg)

![Apple M4 13-inch iPad Pro On Sale for $200 Off [Deal]](https://www.iclarified.com/images/news/97056/97056/97056-640.jpg)