Top Features to Look for in a Reliable BBPS Software Provider

As India advances toward a fully digital economy, the demand for seamless, secure, and scalable bill payment solutions is growing. The Bharat Bill Payment System (BBPS) has emerged as a game-changer in the fintech space, offering a unified platform for various utility bill payments such as electricity, water, DTH, gas, broadband, and more. Whether you’re a fintech entrepreneur, a rural digital service provider, or a retailer looking to expand your business, choosing the right bbps software solution provider is crucial. An efficient BBPS solution not only boosts your service offerings but also helps your customers save time, reduce cash dependence, and adopt digital payment services with confidence. This article explores the top features to look for in a reliable BBPS software provider, with insights that can guide startups, retailers, and digital financial service operators. 1. NPCI-Approved and Fully Compliant Software The first and foremost requirement is compliance. A trusted BBPS software provider should be authorized by NPCI (National Payments Corporation of India) or work in partnership with BBPOUs (Bharat Bill Payment Operating Units). Compliance ensures: Seamless integration with BBPS central systems Real-time settlement and reconciliation Access to all BBPS biller categories Choosing a compliant solution protects your business and your customers from technical issues and legal hurdles. 2. Real-Time Bill Payment Capability Speed is crucial in digital payments. Your BBPS provider should offer real-time bill processing, which means the customer receives confirmation within seconds of completing a transaction. Look for features like: Real-time status updates Instant receipt generation SMS/email alerts to users This enhances the customer experience and builds trust in your service. 3. User-Friendly Retailer Dashboard A good BBPS software provider will offer a simple, intuitive dashboard for retailers or agents. This is especially important in rural and semi-urban areas where digital literacy is still evolving. Ideal dashboard features include: Multilingual support Mobile and desktop versions Easy customer search Printable receipts and transaction history This empowers local shop owners, CSCs (Common Service Centers), and mobile recharge agents to become effective digital bill payment providers. 4. Robust Admin Panel for Business Control If you’re managing multiple agents or planning to scale your operations, look for BBPS software that includes a full-featured admin panel. This should allow you to: Create and manage retailers or agents Monitor transaction reports View commissions earned Set limits and permissions This kind of backend control ensures smooth operations, especially for distributors and aggregators. 5. Multi-Biller Support and Service Categories A reliable BBPS software provider should give you access to a wide range of biller categories, including: Electricity Gas Water DTH Broadband Insurance Loan EMIs Municipal taxes More categories mean more earning potential for retailers and more convenience for end-users—all through a single interface. 6. Secure and Scalable Architecture Security is non-negotiable in digital transactions. Choose a provider that uses: End-to-end encryption PCI DSS-compliant servers OTP verification Two-factor authentication Scalability is another important factor. As your business grows, your software should be able to handle more transactions, users, and agents without lag or downtime. 7. Transparent Commission Structure One of the reasons retailers and service providers adopt BBPS software is the commission-based income model. Your BBPS software provider should offer: Transparent commission structures Real-time commission crediting Auto-settlement or scheduled payouts This incentivizes retailers to offer the service more proactively and helps you grow a network of active digital service points. 8. Reliable Customer Support and Training Even the best software needs support. Make sure your provider offers: 24/7 technical support Training material for agents Live chat or ticketing systems Onboarding assistance Retailers in rural areas may need more handholding, and a responsive support system ensures their issues are resolved quickly. 9. Seamless Integration with Other APIs A future-ready BBPS software should be able to integrate easily with other APIs, such as: AEPS (Aadhaar Enabled Payment System) Mobile Recharge APIs DMT (Domestic Money Transfer) PAN Card Services This helps you create a complete digital service platform, opening multiple income streams from one dashboard. 10. Reports, Analytics, and Compliance Logs Data is power. A reliable provider should give you access to: Daily transaction reports Earnings and commission summaries BBPS compliance logs Agent-wise performance analytics This helps you manage your business, identify top-performing areas, and address issues before they escal

As India advances toward a fully digital economy, the demand for seamless, secure, and scalable bill payment solutions is growing. The Bharat Bill Payment System (BBPS) has emerged as a game-changer in the fintech space, offering a unified platform for various utility bill payments such as electricity, water, DTH, gas, broadband, and more.

Whether you’re a fintech entrepreneur, a rural digital service provider, or a retailer looking to expand your business, choosing the right bbps software solution provider is crucial. An efficient BBPS solution not only boosts your service offerings but also helps your customers save time, reduce cash dependence, and adopt digital payment services with confidence.

This article explores the top features to look for in a reliable BBPS software provider, with insights that can guide startups, retailers, and digital financial service operators.

1. NPCI-Approved and Fully Compliant Software

The first and foremost requirement is compliance. A trusted BBPS software provider should be authorized by NPCI (National Payments Corporation of India) or work in partnership with BBPOUs (Bharat Bill Payment Operating Units).

Compliance ensures:

Seamless integration with BBPS central systems

Real-time settlement and reconciliation

Access to all BBPS biller categories

Choosing a compliant solution protects your business and your customers from technical issues and legal hurdles.

2. Real-Time Bill Payment Capability

Speed is crucial in digital payments. Your BBPS provider should offer real-time bill processing, which means the customer receives confirmation within seconds of completing a transaction.

Look for features like:

Real-time status updates

Instant receipt generation

SMS/email alerts to users

This enhances the customer experience and builds trust in your service.

3. User-Friendly Retailer Dashboard

A good BBPS software provider will offer a simple, intuitive dashboard for retailers or agents. This is especially important in rural and semi-urban areas where digital literacy is still evolving.

Ideal dashboard features include:

Multilingual support

Mobile and desktop versions

Easy customer search

Printable receipts and transaction history

This empowers local shop owners, CSCs (Common Service Centers), and mobile recharge agents to become effective digital bill payment providers.

4. Robust Admin Panel for Business Control

If you’re managing multiple agents or planning to scale your operations, look for BBPS software that includes a full-featured admin panel. This should allow you to:

Create and manage retailers or agents

Monitor transaction reports

View commissions earned

Set limits and permissions

This kind of backend control ensures smooth operations, especially for distributors and aggregators.

5. Multi-Biller Support and Service Categories

A reliable BBPS software provider should give you access to a wide range of biller categories, including:

Electricity

Gas

Water

DTH

Broadband

Insurance

Loan EMIs

Municipal taxes

More categories mean more earning potential for retailers and more convenience for end-users—all through a single interface.

6. Secure and Scalable Architecture

Security is non-negotiable in digital transactions. Choose a provider that uses:

End-to-end encryption

PCI DSS-compliant servers

OTP verification

Two-factor authentication

Scalability is another important factor. As your business grows, your software should be able to handle more transactions, users, and agents without lag or downtime.

7. Transparent Commission Structure

One of the reasons retailers and service providers adopt BBPS software is the commission-based income model. Your BBPS software provider should offer:

Transparent commission structures

Real-time commission crediting

Auto-settlement or scheduled payouts

This incentivizes retailers to offer the service more proactively and helps you grow a network of active digital service points.

8. Reliable Customer Support and Training

Even the best software needs support. Make sure your provider offers:

24/7 technical support

Training material for agents

Live chat or ticketing systems

Onboarding assistance

Retailers in rural areas may need more handholding, and a responsive support system ensures their issues are resolved quickly.

9. Seamless Integration with Other APIs

A future-ready BBPS software should be able to integrate easily with other APIs, such as:

AEPS (Aadhaar Enabled Payment System)

Mobile Recharge APIs

DMT (Domestic Money Transfer)

PAN Card Services

This helps you create a complete digital service platform, opening multiple income streams from one dashboard.

10. Reports, Analytics, and Compliance Logs

Data is power. A reliable provider should give you access to:

Daily transaction reports

Earnings and commission summaries

BBPS compliance logs

Agent-wise performance analytics

This helps you manage your business, identify top-performing areas, and address issues before they escalate.

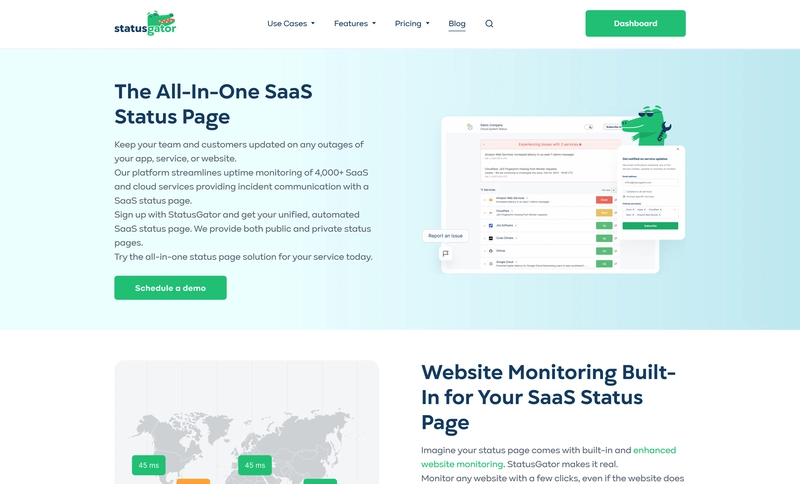

Why Choose Noble Web Studio as Your BBPS Software Provider

If you're looking for a BBPS software provider that meets all the above criteria, Noble Web Studio stands out as a trusted name in India’s fintech software industry. With years of experience in developing digital payment solutions for rural and urban markets, Noble Web Studio offers:

NPCI-compliant BBPS integration

Full-featured admin and agent modules

Secure APIs and scalable architecture

Seamless integration with AEPS, DMT, and Recharge APIs

Transparent commission structures

Multilingual and mobile-compatible dashboards

Whether you are a startup, fintech aggregator, or local retailer, partnering with a provider like Noble Web Studio ensures you get a reliable and secure BBPS software solution tailored to your business needs.

Conclusion

The BBPS ecosystem is transforming how India pays its bills—especially in rural and underserved areas. To be part of this digital revolution, it’s essential to choose a BBPS software provider that offers reliability, compliance, ease of use, and future-ready features.

From real-time payments and secure transactions to scalable platforms and agent management, these are the features that make your bill payment service both trusted and profitable.

As rural digital adoption continues to rise, having the right BBPS software is not just a business choice—it’s a step toward bridging the digital divide and promoting financial inclusion.

![[Webinar] AI Is Already Inside Your SaaS Stack — Learn How to Prevent the Next Silent Breach](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiOWn65wd33dg2uO99NrtKbpYLfcepwOLidQDMls0HXKlA91k6HURluRA4WXgJRAZldEe1VReMQZyyYt1PgnoAn5JPpILsWlXIzmrBSs_TBoyPwO7hZrWouBg2-O3mdeoeSGY-l9_bsZB7vbpKjTSvG93zNytjxgTaMPqo9iq9Z5pGa05CJOs9uXpwHFT4/s1600/ai-cyber.jpg?#)

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Rogue Company Elite tier list of best characters [April 2025]](https://media.pocketgamer.com/artwork/na-33136-1657102075/rogue-company-ios-android-tier-cover.jpg?#)

![Here’s the first live demo of Android XR on Google’s prototype smart glasses [Video]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/04/google-android-xr-ted-glasses-demo-3.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![New Beats USB-C Charging Cables Now Available on Amazon [Video]](https://www.iclarified.com/images/news/97060/97060/97060-640.jpg)

![Apple M4 13-inch iPad Pro On Sale for $200 Off [Deal]](https://www.iclarified.com/images/news/97056/97056/97056-640.jpg)