How to Handle Disputes in Payment Integration with Razor pay

Disputes Overview Disputes arise when a customer or their bank questions a payment's legitimacy. Common reasons include: Unauthorized transactions (customer claims they didn’t authorize the payment). Non-receipt of goods or services. Billing errors or overcharging. When a dispute is initiated, the payment is put under review, and the customer’s bank may reach out to the merchant for resolution. Dispute Phases Fraud: The bank suspects fraud and raises a dispute. Retrieval: The customer requests more details about the transaction (a "soft" chargeback). Chargeback: The customer’s bank starts an official inquiry for a refund. Pre-Arbitration: A chargeback that you won is challenged again by the customer. Arbitration: The chargeback is challenged for the third time, involving card networks, leading to potential high costs. Dispute Statuses Open: The dispute has been created and is under review. Under Review: The bank is assessing the dispute details. Won: Your evidence was accepted, and the money stays with you. Lost: Your evidence was rejected, and the money is refunded to the customer. Closed: The dispute is resolved, either by refunding the customer or providing sufficient information. Dispute Process Flow Dispute Initiation: By Issuing Bank: The bank detects fraud and requests an explanation. By Customer: The customer reports unauthorized charges to their bank. Notification: You receive a dispute notification. Accept the Dispute: Fraud Cases: Refund the customer manually. Other Cases: Razorpay handles the refund automatically. Contest the Dispute: Provide evidence that the transaction was legitimate. Bank Review: The bank reviews your evidence and makes a decision. Outcome: Lost: The disputed amount is deducted and refunded to the customer. Won: You retain the amount if your evidence is accepted. Managing Disputes on Razorpay Using Razorpay Dashboard 1. View Disputes Log in to the Razorpay Dashboard. Navigate to Transactions > Disputes. Click on a Dispute ID to see details. 2. Accept Disputes If the dispute is valid, accept it. Steps: Log in to the Dashboard. Go to Transactions > Disputes. Click on a Dispute ID, then Accept Dispute. Confirm by clicking Yes, Accept. 3. Contest Disputes If you believe the dispute is invalid, contest it with evidence. Steps: Log in to the Dashboard. Go to Transactions > Disputes. Click on a Dispute ID, then Contest & Upload Evidence. Choose full/partial contest, provide an explanation, and upload supporting documents. Click Submit Evidence and confirm. Using Razorpay APIs 1. View Disputes {% raw %} GET /v1/disputes GET /v1/disputes/{dispute_id} {% endraw %} 2. Accept Disputes {% raw %} POST /v1/disputes/{dispute_id}/accept {% endraw %} 3. Contest Disputes {% raw %} POST /v1/disputes/{dispute_id}/contest POST /v1/documents {% endraw %} Subscribe to Webhooks Get real-time dispute notifications by subscribing to webhook events. How to Subscribe: Log in to the Razorpay Dashboard. Navigate to Account & Settings > Webhooks to subscribe. Webhook Events: {% raw %} payment.dispute.created payment.dispute.won payment.dispute.lost payment.dispute.closed payment.dispute.under_review payment.dispute.action_required {% endraw %} For more details, refer to Razorpay’s Webhooks Documentation. Accepting the Dispute Fraud Cases: If the dispute is fraud-related (e.g., unauthorized transactions), refund the customer manually. Use the Refund API or Razorpay’s Dashboard to process the refund. Other Cases: Auto-Refund: If the dispute is not fraud-related (e.g., delivery issues), Razorpay automatically handles the refund. Handling disputes effectively ensures smooth payment processing and better customer relationships.

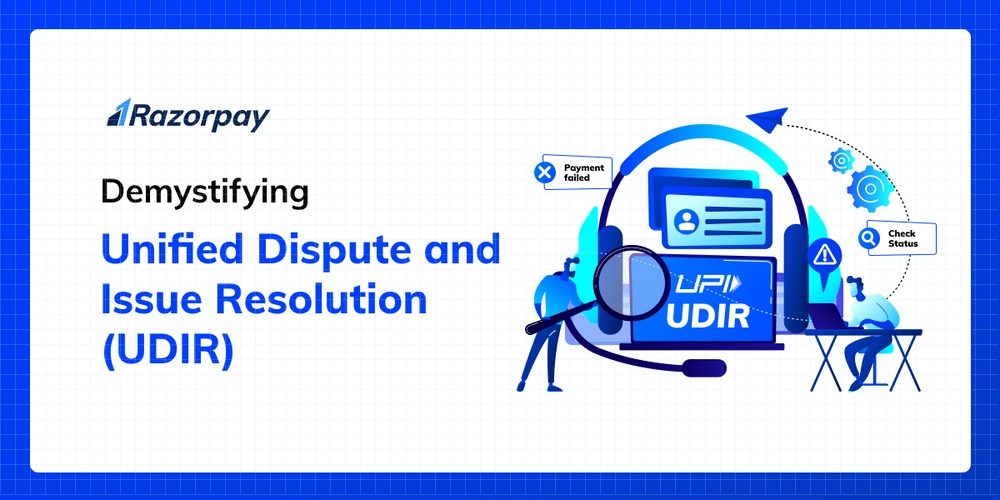

Disputes Overview

Disputes arise when a customer or their bank questions a payment's legitimacy. Common reasons include:

- Unauthorized transactions (customer claims they didn’t authorize the payment).

- Non-receipt of goods or services.

- Billing errors or overcharging.

When a dispute is initiated, the payment is put under review, and the customer’s bank may reach out to the merchant for resolution.

Dispute Phases

- Fraud: The bank suspects fraud and raises a dispute.

- Retrieval: The customer requests more details about the transaction (a "soft" chargeback).

- Chargeback: The customer’s bank starts an official inquiry for a refund.

- Pre-Arbitration: A chargeback that you won is challenged again by the customer.

- Arbitration: The chargeback is challenged for the third time, involving card networks, leading to potential high costs.

Dispute Statuses

- Open: The dispute has been created and is under review.

- Under Review: The bank is assessing the dispute details.

- Won: Your evidence was accepted, and the money stays with you.

- Lost: Your evidence was rejected, and the money is refunded to the customer.

- Closed: The dispute is resolved, either by refunding the customer or providing sufficient information.

Dispute Process Flow

-

Dispute Initiation:

- By Issuing Bank: The bank detects fraud and requests an explanation.

- By Customer: The customer reports unauthorized charges to their bank.

-

Notification:

- You receive a dispute notification.

-

Accept the Dispute:

- Fraud Cases: Refund the customer manually.

- Other Cases: Razorpay handles the refund automatically.

-

Contest the Dispute:

- Provide evidence that the transaction was legitimate.

-

Bank Review:

- The bank reviews your evidence and makes a decision.

-

Outcome:

- Lost: The disputed amount is deducted and refunded to the customer.

- Won: You retain the amount if your evidence is accepted.

Managing Disputes on Razorpay

Using Razorpay Dashboard

1. View Disputes

- Log in to the Razorpay Dashboard.

- Navigate to Transactions > Disputes.

- Click on a Dispute ID to see details.

2. Accept Disputes

- If the dispute is valid, accept it.

- Steps:

- Log in to the Dashboard.

- Go to Transactions > Disputes.

- Click on a Dispute ID, then Accept Dispute.

- Confirm by clicking Yes, Accept.

3. Contest Disputes

- If you believe the dispute is invalid, contest it with evidence.

- Steps:

- Log in to the Dashboard.

- Go to Transactions > Disputes.

- Click on a Dispute ID, then Contest & Upload Evidence.

- Choose full/partial contest, provide an explanation, and upload supporting documents.

- Click Submit Evidence and confirm.

Using Razorpay APIs

1. View Disputes

{% raw %}

GET /v1/disputes

GET /v1/disputes/{dispute_id}

{% endraw %}

2. Accept Disputes

{% raw %}

POST /v1/disputes/{dispute_id}/accept

{% endraw %}

3. Contest Disputes

{% raw %}

POST /v1/disputes/{dispute_id}/contest

POST /v1/documents

{% endraw %}

Subscribe to Webhooks

Get real-time dispute notifications by subscribing to webhook events.

How to Subscribe:

- Log in to the Razorpay Dashboard.

- Navigate to Account & Settings > Webhooks to subscribe.

Webhook Events:

{% raw %}

payment.dispute.created

payment.dispute.won

payment.dispute.lost

payment.dispute.closed

payment.dispute.under_review

payment.dispute.action_required

{% endraw %}

For more details, refer to Razorpay’s Webhooks Documentation.

Accepting the Dispute

Fraud Cases:

- If the dispute is fraud-related (e.g., unauthorized transactions), refund the customer manually.

- Use the Refund API or Razorpay’s Dashboard to process the refund.

Other Cases:

- Auto-Refund: If the dispute is not fraud-related (e.g., delivery issues), Razorpay automatically handles the refund.

Handling disputes effectively ensures smooth payment processing and better customer relationships.

![[The AI Show Episode 142]: ChatGPT’s New Image Generator, Studio Ghibli Craze and Backlash, Gemini 2.5, OpenAI Academy, 4o Updates, Vibe Marketing & xAI Acquires X](https://www.marketingaiinstitute.com/hubfs/ep%20142%20cover.png)

![[DEALS] The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From drop-out to software architect with Jason Lengstorf [Podcast #167]](https://cdn.hashnode.com/res/hashnode/image/upload/v1743796461357/f3d19cd7-e6f5-4d7c-8bfc-eb974bc8da68.png?#)

.png?#)

_Christophe_Coat_Alamy.jpg?#)

(1).webp?#)

![Apple Considers Delaying Smart Home Hub Until 2026 [Gurman]](https://www.iclarified.com/images/news/96946/96946/96946-640.jpg)

![iPhone 17 Pro Won't Feature Two-Toned Back [Gurman]](https://www.iclarified.com/images/news/96944/96944/96944-640.jpg)

![Tariffs Threaten Apple's $999 iPhone Price Point in the U.S. [Gurman]](https://www.iclarified.com/images/news/96943/96943/96943-640.jpg)