AEPS Software: The Future of Banking for Agents & Retailers

The Aadhaar Enabled Payment System (AEPS) has transformed the way financial transactions take place in India. With AEPS, banking services have become more accessible, allowing people to withdraw cash, check balances, and transfer funds using their Aadhaar-linked bank accounts. For agents and retailers, AEPS software is a powerful tool to provide seamless banking services while earning commission on transactions. Noble Web Studio offers a feature-rich AEPS software solution that is secure, user-friendly, and designed for financial growth. What is AEPS Software? AEPS software allows banking agents and retailers to offer financial services through biometric authentication. This eliminates the need for physical debit or credit cards, making banking more accessible in rural and semi-urban areas. With AEPS software, users can: Withdraw cash Check account balance Transfer funds Generate mini statements Perform Aadhaar Pay transactions By integrating AEPS software into their business, agents and retailers can enhance their services and increase customer footfall. How AEPS Software Benefits Agents & Retailers 1. Earn Commission on Every Transaction Every AEPS transaction processed through an agent or retailer earns them a commission. More transactions mean more revenue, making it a profitable business model. 2. Expand Your Customer Base Many people in rural areas do not have access to traditional banking facilities. By offering AEPS services, agents and retailers can attract a larger customer base and build long-term relationships. 3. Easy Setup & Low Investment Unlike a full-fledged bank branch, AEPS software requires minimal investment. A simple biometric device and a smartphone or computer are enough to get started. 4. Instant Transactions AEPS software ensures real-time transactions with quick processing, enhancing customer satisfaction. 5. Secure and Reliable With biometric authentication and end-to-end encryption, AEPS software offers high-level security, preventing fraud and unauthorized transactions. Key Features of the Best AEPS Software For agents and retailers to offer smooth banking services, choosing the right AEPS software is crucial. Here are some important features to look for: 1. Multi-Bank Support The software should support multiple banks, allowing customers from different banks to perform transactions without hassle. 2. User-Friendly Interface A simple and intuitive dashboard makes it easier for agents to process transactions efficiently. 3. Seamless API Integration AEPS software should integrate smoothly with NPCI (National Payments Corporation of India) and banking networks for flawless operations. 4. 24/7 Technical Support Reliable customer support ensures that agents can resolve any technical issues without affecting business operations. 5. Transaction Tracking & Reports A detailed transaction history and reports help agents monitor their earnings and manage their services better. Why Choose Noble Web Studio for AEPS Software? Noble Web Studio provides one of the best AEPS software solutions, designed to enhance banking accessibility for agents and retailers. Here’s why businesses trust us: 1. Secure & Compliant Solution Our AEPS software follows PCI-DSS security standards, ensuring secure transactions for both agents and customers. 2. Customizable & Scalable Whether you’re a small retailer or a large-scale agent network, our software is flexible and can be customized to suit your needs. 3. Quick & Easy Integration We provide seamless API integration, making it easy to connect with banks and payment networks. 4. Transparent Commission Structure We ensure fair commission earnings for every transaction, maximizing revenue potential for agents. 5. Regular Updates & Support We provide regular software updates and 24/7 support to keep your services running smoothly. The Future of AEPS in Digital Banking With the increasing demand for cashless and Aadhaar-based transactions, AEPS is set to play a major role in the future of digital banking. Financial inclusion is expanding, and businesses that adopt AEPS software now will gain a competitive advantage in the market. Conclusion AEPS software is a game-changer for agents and retailers, offering a simple, secure, and profitable way to provide banking services. With Noble Web Studio’s AEPS software, businesses can increase revenue, serve more customers, and stay ahead in the digital banking revolution. Get started with Noble Web Studio’s AEPS software today and take your financial services to the next level!

The Aadhaar Enabled Payment System (AEPS) has transformed the way financial transactions take place in India. With AEPS, banking services have become more accessible, allowing people to withdraw cash, check balances, and transfer funds using their Aadhaar-linked bank accounts.

For agents and retailers, AEPS software is a powerful tool to provide seamless banking services while earning commission on transactions. Noble Web Studio offers a feature-rich AEPS software solution that is secure, user-friendly, and designed for financial growth.

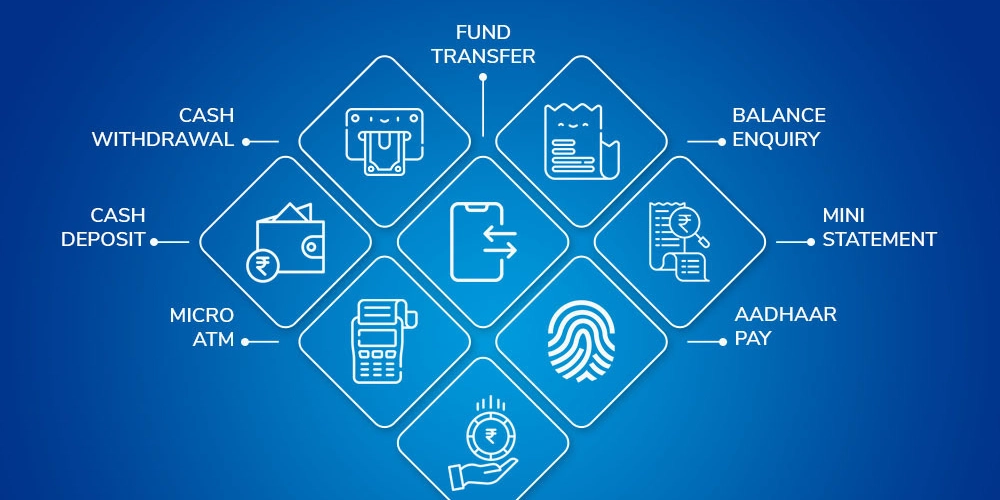

What is AEPS Software?

AEPS software allows banking agents and retailers to offer financial services through biometric authentication. This eliminates the need for physical debit or credit cards, making banking more accessible in rural and semi-urban areas.

With AEPS software, users can:

Withdraw cash

Check account balance

Transfer funds

Generate mini statements

Perform Aadhaar Pay transactions

By integrating AEPS software into their business, agents and retailers can enhance their services and increase customer footfall.

How AEPS Software Benefits Agents & Retailers

1. Earn Commission on Every Transaction

Every AEPS transaction processed through an agent or retailer earns them a commission. More transactions mean more revenue, making it a profitable business model.

2. Expand Your Customer Base

Many people in rural areas do not have access to traditional banking facilities. By offering AEPS services, agents and retailers can attract a larger customer base and build long-term relationships.

3. Easy Setup & Low Investment

Unlike a full-fledged bank branch, AEPS software requires minimal investment. A simple biometric device and a smartphone or computer are enough to get started.

4. Instant Transactions

AEPS software ensures real-time transactions with quick processing, enhancing customer satisfaction.

5. Secure and Reliable

With biometric authentication and end-to-end encryption, AEPS software offers high-level security, preventing fraud and unauthorized transactions.

Key Features of the Best AEPS Software

For agents and retailers to offer smooth banking services, choosing the right AEPS software is crucial. Here are some important features to look for:

1. Multi-Bank Support

The software should support multiple banks, allowing customers from different banks to perform transactions without hassle.

2. User-Friendly Interface

A simple and intuitive dashboard makes it easier for agents to process transactions efficiently.

3. Seamless API Integration

AEPS software should integrate smoothly with NPCI (National Payments Corporation of India) and banking networks for flawless operations.

4. 24/7 Technical Support

Reliable customer support ensures that agents can resolve any technical issues without affecting business operations.

5. Transaction Tracking & Reports

A detailed transaction history and reports help agents monitor their earnings and manage their services better.

Why Choose Noble Web Studio for AEPS Software?

Noble Web Studio provides one of the best AEPS software solutions, designed to enhance banking accessibility for agents and retailers. Here’s why businesses trust us:

1. Secure & Compliant Solution

Our AEPS software follows PCI-DSS security standards, ensuring secure transactions for both agents and customers.

2. Customizable & Scalable

Whether you’re a small retailer or a large-scale agent network, our software is flexible and can be customized to suit your needs.

3. Quick & Easy Integration

We provide seamless API integration, making it easy to connect with banks and payment networks.

4. Transparent Commission Structure

We ensure fair commission earnings for every transaction, maximizing revenue potential for agents.

5. Regular Updates & Support

We provide regular software updates and 24/7 support to keep your services running smoothly.

The Future of AEPS in Digital Banking

With the increasing demand for cashless and Aadhaar-based transactions, AEPS is set to play a major role in the future of digital banking. Financial inclusion is expanding, and businesses that adopt AEPS software now will gain a competitive advantage in the market.

Conclusion

AEPS software is a game-changer for agents and retailers, offering a simple, secure, and profitable way to provide banking services. With Noble Web Studio’s AEPS software, businesses can increase revenue, serve more customers, and stay ahead in the digital banking revolution.

Get started with Noble Web Studio’s AEPS software today and take your financial services to the next level!

![[The AI Show Episode 142]: ChatGPT’s New Image Generator, Studio Ghibli Craze and Backlash, Gemini 2.5, OpenAI Academy, 4o Updates, Vibe Marketing & xAI Acquires X](https://www.marketingaiinstitute.com/hubfs/ep%20142%20cover.png)

![[DEALS] The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From drop-out to software architect with Jason Lengstorf [Podcast #167]](https://cdn.hashnode.com/res/hashnode/image/upload/v1743796461357/f3d19cd7-e6f5-4d7c-8bfc-eb974bc8da68.png?#)

.png?#)

_Christophe_Coat_Alamy.jpg?#)

(1).webp?#)

![Apple Considers Delaying Smart Home Hub Until 2026 [Gurman]](https://www.iclarified.com/images/news/96946/96946/96946-640.jpg)

![iPhone 17 Pro Won't Feature Two-Toned Back [Gurman]](https://www.iclarified.com/images/news/96944/96944/96944-640.jpg)

![Tariffs Threaten Apple's $999 iPhone Price Point in the U.S. [Gurman]](https://www.iclarified.com/images/news/96943/96943/96943-640.jpg)