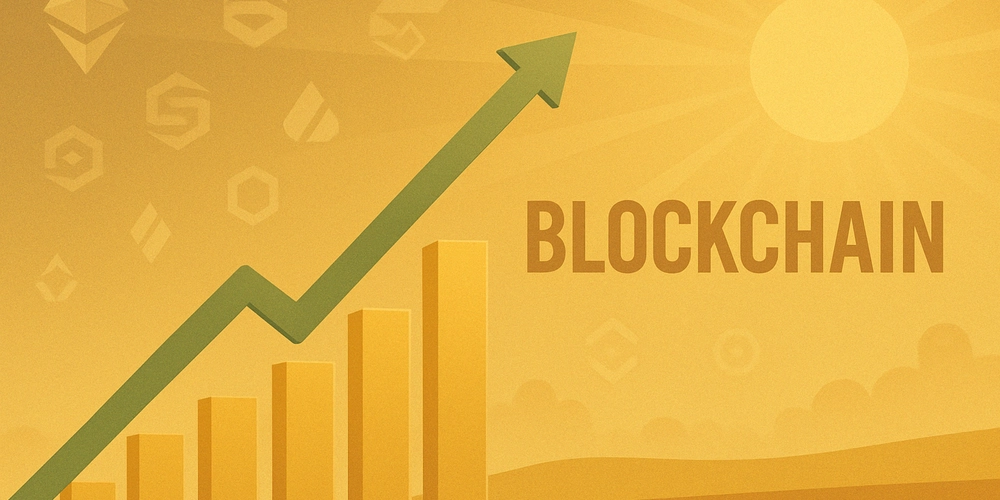

Crypto news today: US inflation at 2.4% sends Bitcoin to $82K

Bitcoin and Ethereum prices rise as US inflation drops to 2.4%. Lower-than-expected inflation data boosts market optimism. Trump’s delay of tariff hikes eases trade-related uncertainties. Bitcoin, Ethereum, and other cryptocurrencies experienced a surge in value on Wednesday, buoyed by the release of the latest US inflation data, which revealed a smaller-than-expected increase. The Consumer Price […] The post Crypto news today: US inflation at 2.4% sends Bitcoin to $82K appeared first on CoinJournal.

- Bitcoin and Ethereum prices rise as US inflation drops to 2.4%.

- Lower-than-expected inflation data boosts market optimism.

- Trump’s delay of tariff hikes eases trade-related uncertainties.

Bitcoin, Ethereum, and other cryptocurrencies experienced a surge in value on Wednesday, buoyed by the release of the latest US inflation data, which revealed a smaller-than-expected increase.

The Consumer Price Index (CPI) for March showed a year-over-year increase of 2.4%, falling short of the predicted 2.6%.

Core CPI, which excludes volatile food and energy prices, also cooled, rising 2.8%, down from 3.1% in February, signaling a potential shift in the inflationary landscape.

The encouraging inflation data provided much-needed relief to markets, including crypto assets like Bitcoin, which jumped 7.5% to reach $82,000, signaling a strong recovery.

Ethereum also gained ground, climbing to $1,600, while Solana experienced an impressive 11% surge, reaching around $114, reflecting the positive sentiment sweeping across the digital asset space.

Trump’s tariff delay: easing trade uncertainty

This positive inflation report comes on the heels of President Donald Trump’s decision to delay further tariff hikes for 90 days, a move that has helped to ease some of the trade-related uncertainties that have been weighing on global markets.

While Trump had previously imposed higher tariffs on Chinese goods and raised tariffs on foreign cars and auto parts, creating concerns about an escalating trade war, the suspension of some tariffs has elicited a positive response from the market, helping to calm fears of a potential economic slowdown.

Despite this temporary reprieve, Trump has maintained a hard-line stance on trade, particularly with China, increasing tariffs on Chinese imports to 125%.

The Federal Reserve has been closely monitoring both inflation and the potential impact of these tariffs, carefully weighing the risks to the US economy.

While inflation has shown signs of easing, it remains above the Fed’s 2% target, and this latest data marks only the second consecutive month of decreasing inflation and core inflation, indicating that the battle against inflation is far from over.

Hope for rate cuts: a dovish turn by the Fed?

The decline in inflation has bolstered optimism in the markets, with Bitcoin and Ethereum, along with other cryptocurrencies, benefitting from the renewed confidence.

Investors are now increasingly hopeful that a sustained decrease in inflation could eventually lead to a more dovish stance by the Federal Reserve, including potential interest rate cuts, which could further stimulate economic growth and boost asset prices.

Analysts are closely scrutinizing future CPI reports to gauge the long-term impact of tariffs on inflation moving forward.

The March inflation data, showing a notable drop despite the increase in tariffs, has offered the markets a sense of relief, raising hopes that the Federal Reserve might adjust its policies to counter economic pressure.

The combination of a pause in some tariffs and the better-than-expected inflation figures has provided welcome support for both equities and cryptocurrencies, creating a more positive outlook.

As for Bitcoin, its price hovered around $82,000, marking a 7.5% increase over the past day, while Ethereum rose by 11%, signaling renewed investor interest.

The broader market also experienced positive momentum following the inflation news, but the Federal Reserve’s response remains uncertain and is being closely watched by market participants.

The latest data suggests a potential shift in inflationary trends, even as trade tensions with China continue to exert a powerful influence on market sentiment.

The post Crypto news today: US inflation at 2.4% sends Bitcoin to $82K appeared first on CoinJournal.

![[Webinar] AI Is Already Inside Your SaaS Stack — Learn How to Prevent the Next Silent Breach](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiOWn65wd33dg2uO99NrtKbpYLfcepwOLidQDMls0HXKlA91k6HURluRA4WXgJRAZldEe1VReMQZyyYt1PgnoAn5JPpILsWlXIzmrBSs_TBoyPwO7hZrWouBg2-O3mdeoeSGY-l9_bsZB7vbpKjTSvG93zNytjxgTaMPqo9iq9Z5pGa05CJOs9uXpwHFT4/s1600/ai-cyber.jpg?#)

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Rogue Company Elite tier list of best characters [April 2025]](https://media.pocketgamer.com/artwork/na-33136-1657102075/rogue-company-ios-android-tier-cover.jpg?#)

![Here’s the first live demo of Android XR on Google’s prototype smart glasses [Video]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/04/google-android-xr-ted-glasses-demo-3.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![New Beats USB-C Charging Cables Now Available on Amazon [Video]](https://www.iclarified.com/images/news/97060/97060/97060-640.jpg)

![Apple M4 13-inch iPad Pro On Sale for $200 Off [Deal]](https://www.iclarified.com/images/news/97056/97056/97056-640.jpg)