Titan Capital: India’s sole representative on Business Insider’s top 100 early-stage investors list

Titan Capital: India’s Sole Representative on Business Insider’s Top 100 Early-Stage Investors List Rohit Bansal and Kunal Bahl

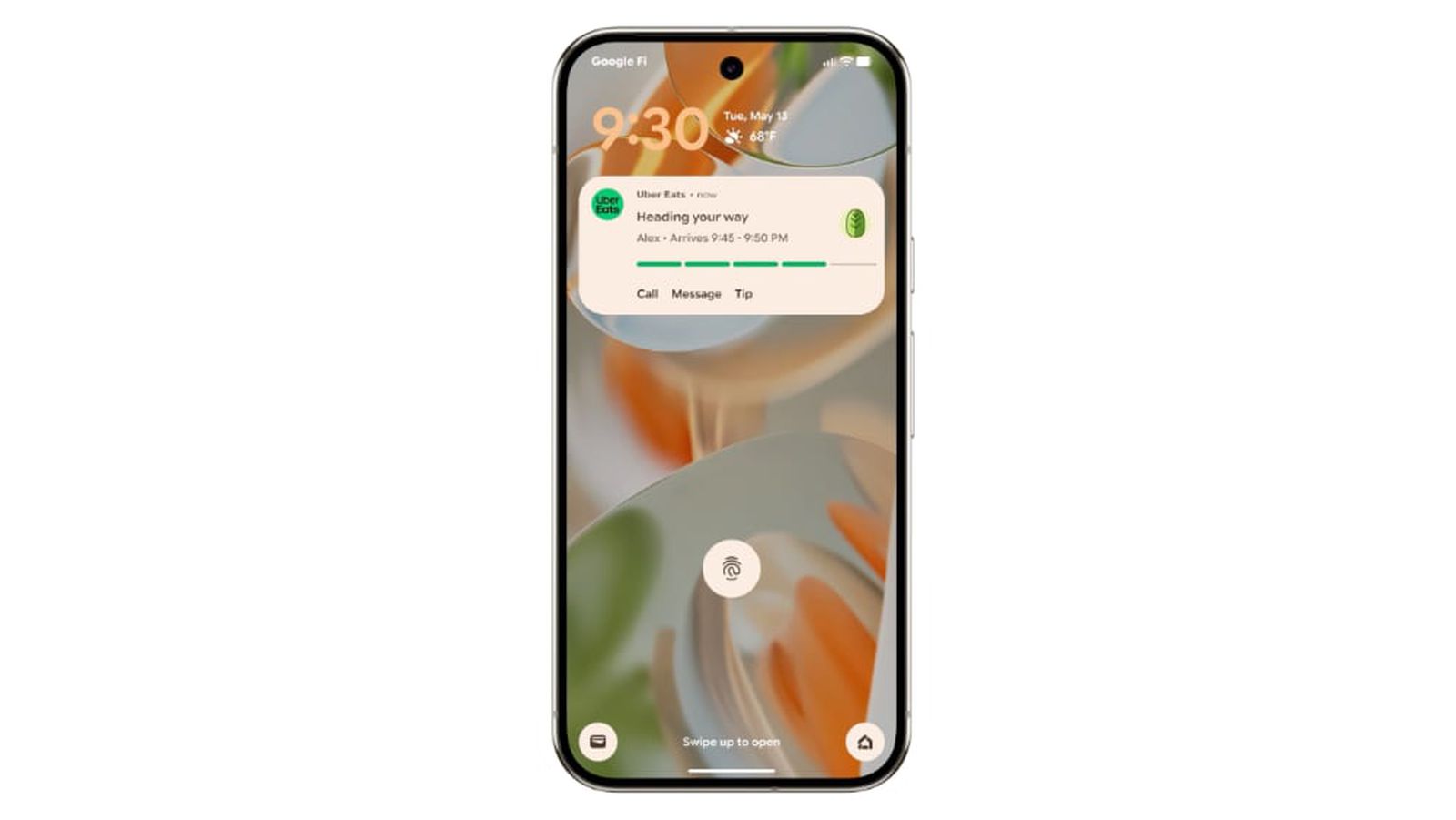

Rohit Bansal and Kunal Bahl, known for co-founding Snapdeal, have become significant figures in India’s startup ecosystem. After establishing one of the country’s leading e-commerce platforms, they launched Titan Capital, a venture capital firm with a clear focus on early-stage investments in India.

Titan Capital’s recent inclusion in Business Insider’s list of the top 100 early-stage investors marks a milestone for the firm and for India’s growing presence in global venture capital. Notably, Titan Capital is the only India-focused venture capital firm to appear on the list, underscoring the rising influence of localized investment expertise in a sector often dominated by global players.

Supporting India’s Next Generation of Entrepreneurs

Bansal and Bahl’s approach at Titan Capital is shaped by their own entrepreneurial journey. Rather than solely providing capital, they take an active role in supporting founders, drawing on their experience navigating the complexities of building a business in India. This involvement extends from strategic guidance to leveraging their networks for partnerships and follow-on funding. The firm’s engagement with portfolio companies is rooted in the challenges and lessons learned during Snapdeal’s growth, offering a perspective that is both practical and contextually relevant for Indian startups.

Titan Capital’s investment philosophy emphasizes long-term sustainability over short-term gains. The founders advocate for building resilient businesses, reflecting a broader shift in India’s startup culture toward sustainable growth. Their work with startups goes beyond financial investment, encompassing mentorship and access to resources that are often critical for early-stage companies operating in a rapidly changing market.

India-Centric Investment Strategy

While many venture capital firms diversify across regions, Titan Capital maintains a concentrated focus on India. This strategy reflects a belief in the country’s potential for innovation and scale. The firm’s portfolio spans sectors including technology, fintech, and consumer brands, with each investment selected for its relevance to the Indian market and its potential to address local challenges.

Bansal and Bahl’s familiarity with the Indian business landscape enables them to offer insights that are tailored to the unique regulatory, operational, and cultural dynamics faced by startups in India. Their sector-agnostic approach allows them to back a wide range of companies, but the common thread is a commitment to supporting businesses that can thrive in India’s diverse and competitive environment.

Recognition and Broader Implications

Business Insider’s recognition of Titan Capital highlights the growing visibility of Indian venture capital on the world stage. The listing notes the firm’s hands-on approach and its ability to identify promising businesses with long-term potential. Titan Capital’s status as the only India-focused VC on the list points to a shift in how the global investment community views the Indian market: not just as a destination for capital, but as a source of high-quality investment leadership.

This recognition comes at a time when India’s startup ecosystem is maturing, with an increasing number of companies achieving scale and profitability. Titan Capital’s trajectory reflects broader trends in the market, including a greater emphasis on founder support, sustainable business models, and the development of a robust entrepreneurial community.

As India’s startup landscape evolves, firms like Titan Capital are likely to play an increasingly prominent role. The firm’s continued focus on early-stage companies, particularly those working on technology and innovation, positions it at the center of the next phase of growth in the sector. The recognition from Business Insider is both a validation of Titan Capital’s approach and an indication of the growing importance of India’s homegrown venture capital firms in shaping the future of entrepreneurship, both locally and globally.

![[The AI Show Episode 147]: OpenAI Abandons For-Profit Plan, AI College Cheating Epidemic, Apple Says AI Will Replace Search Engines & HubSpot’s AI-First Scorecard](https://www.marketingaiinstitute.com/hubfs/ep%20147%20cover.png)

.jpeg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-xl.jpg)

![Apple Working on Brain-Controlled iPhone With Synchron [Report]](https://www.iclarified.com/images/news/97312/97312/97312-640.jpg)